Windfall Elimination Chart

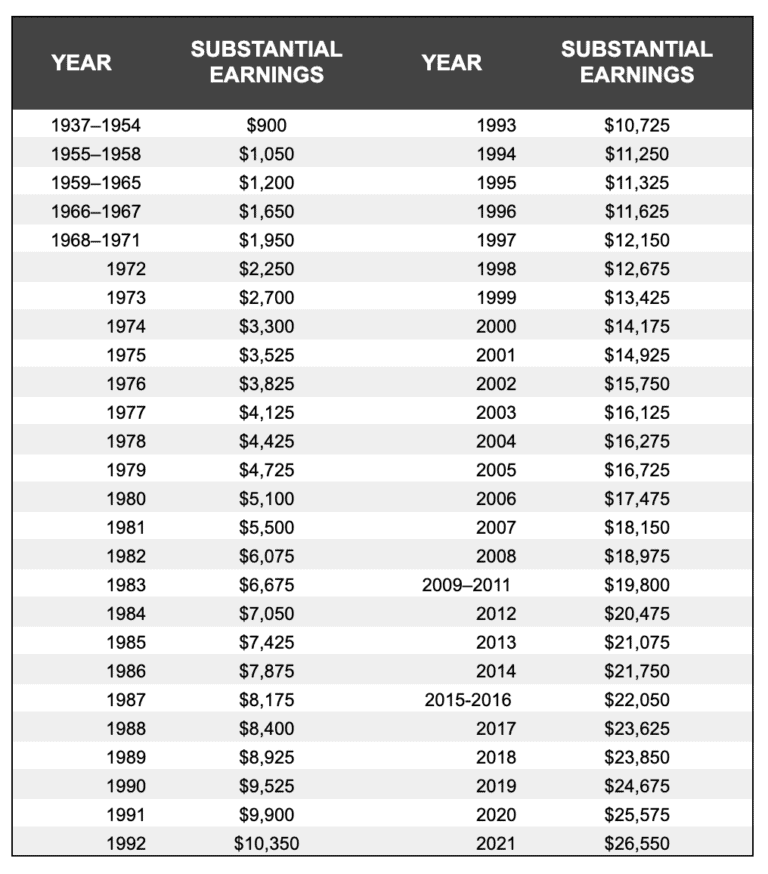

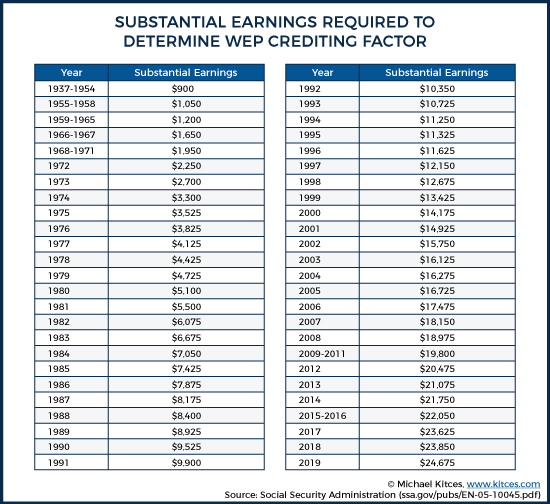

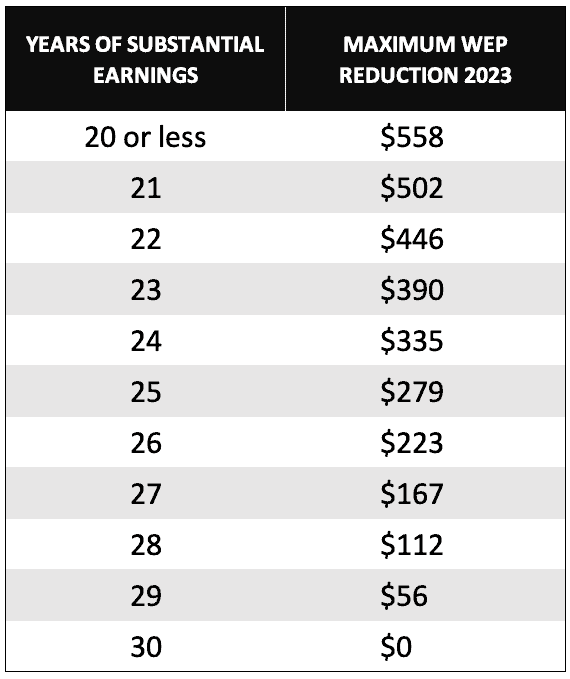

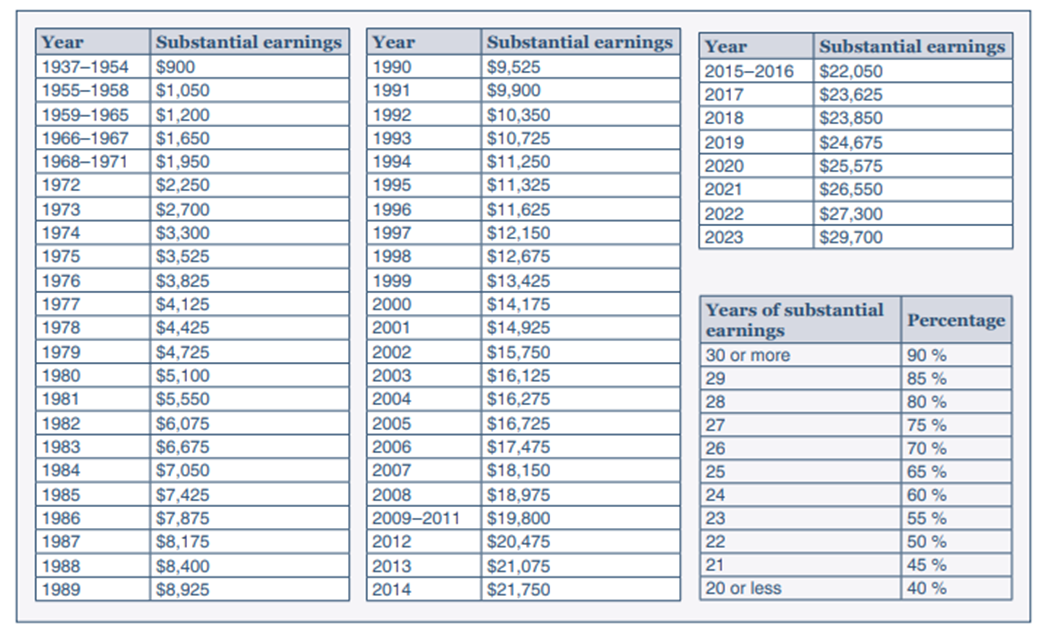

Windfall Elimination Chart - If you qualify for social security and collect a pension from a job that doesn’t pay fica taxes, your social security income will be reduced but not eliminated. Social security uses tax information from the year before last, but you can ask the ssa to reconsider your premium calculation. Learn more about credits are pooled together. The united states has international agreements with over 20 foreign countries for people who have worked abroad. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. A separate rule, the government pension offset (gpo), covered people who received. The windfall elimination provision affected social security retirement and disability benefits. If you apply one to five months after you. In december 2024, congress repealed the windfall elimination provision (wep) and the government pension offset (gpo), ending policies that for more than four decades reduced. Maybe you get a paycheck every two weeks or a social security payment once a month. ‘windfall’ provision did not apply unlike some government pensions, military retirement pay was not subject to the windfall elimination provision (wep), so former service members did. The united states has international agreements with over 20 foreign countries for people who have worked abroad. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. A separate rule, the government pension offset (gpo), covered people who received. Learn more about credits are pooled together. If you are at full retirement age, which varies according to the year you were born, social security will pay benefits starting that month. Maybe you get a paycheck every two weeks or a social security payment once a month. In december 2024, congress repealed the windfall elimination provision (wep) and the government pension offset (gpo), ending policies that for more than four decades reduced. The windfall elimination provision affected social security retirement and disability benefits. For most of your life, money comes in at a slow and somewhat steady pace. In december 2024, congress repealed the windfall elimination provision (wep) and the government pension offset (gpo), ending policies that for more than four decades reduced. A separate rule, the government pension offset (gpo), covered people who received. Learn more about credits are pooled together. If you are at full retirement age, which varies according to the year you were born,. If you apply one to five months after you. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. Maybe you get a paycheck every two weeks or a social security payment once a month. If you qualify for social security and collect a pension from. For most of your life, money comes in at a slow and somewhat steady pace. If you apply one to five months after you. Maybe you get a paycheck every two weeks or a social security payment once a month. If you are at full retirement age, which varies according to the year you were born, social security will pay. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. The windfall elimination provision affected social security retirement and disability benefits. The united states has international agreements with over 20 foreign countries for people who have worked abroad. Learn more about credits are pooled together. If. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. For most of your life, money comes in at a slow and somewhat steady pace. Social security uses tax information from the year before last, but you can ask the ssa to reconsider your premium calculation.. If you are at full retirement age, which varies according to the year you were born, social security will pay benefits starting that month. For most of your life, money comes in at a slow and somewhat steady pace. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos. Maybe you get a paycheck every two weeks or a social security payment once a month. The windfall elimination provision affected social security retirement and disability benefits. ‘windfall’ provision did not apply unlike some government pensions, military retirement pay was not subject to the windfall elimination provision (wep), so former service members did. A separate rule, the government pension offset. The windfall elimination provision affected social security retirement and disability benefits. Learn more about credits are pooled together. ‘windfall’ provision did not apply unlike some government pensions, military retirement pay was not subject to the windfall elimination provision (wep), so former service members did. If you qualify for social security and collect a pension from a job that doesn’t pay. A separate rule, the government pension offset (gpo), covered people who received. ‘windfall’ provision did not apply unlike some government pensions, military retirement pay was not subject to the windfall elimination provision (wep), so former service members did. Social security uses tax information from the year before last, but you can ask the ssa to reconsider your premium calculation. The. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. ‘windfall’ provision did not apply unlike some government pensions, military retirement pay was not subject to the windfall elimination provision (wep), so former service members did. For most of your life, money comes in at a. For most of your life, money comes in at a slow and somewhat steady pace. Maybe you get a paycheck every two weeks or a social security payment once a month. A separate rule, the government pension offset (gpo), covered people who received. The windfall elimination provision affected social security retirement and disability benefits. If you are at full retirement age, which varies according to the year you were born, social security will pay benefits starting that month. Learn more about credits are pooled together. La wep es una fórmula que reduciría tus beneficios si recibes pensión de un trabajo en el que no pagaste impuestos del seguro social. If you qualify for social security and collect a pension from a job that doesn’t pay fica taxes, your social security income will be reduced but not eliminated. Social security uses tax information from the year before last, but you can ask the ssa to reconsider your premium calculation. If you apply one to five months after you.Substantial Earnings for Social Security’s Windfall Elimination Provision Social Security

Social Security’s Windfall Elimination Provision Estate Plan Smith Barid Firm

Windfall Elimination Provision (How To Reduce It) YouTube

Substantial Earnings for Social Security’s Windfall Elimination Provision Social Security

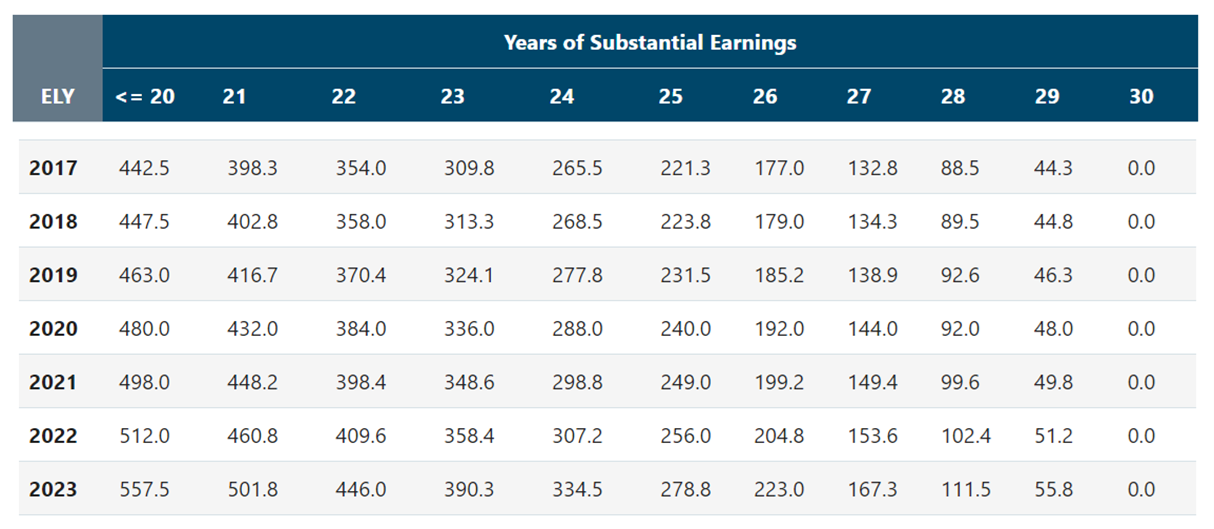

Navigating The Windfall Elimination Provision With A Government Pension

How Social Security's Windfall Elimination Provision Affects Some Federal Retirees

Understanding CSRS Offset Retirement Pension and the Windfall Elimination Provision Federal

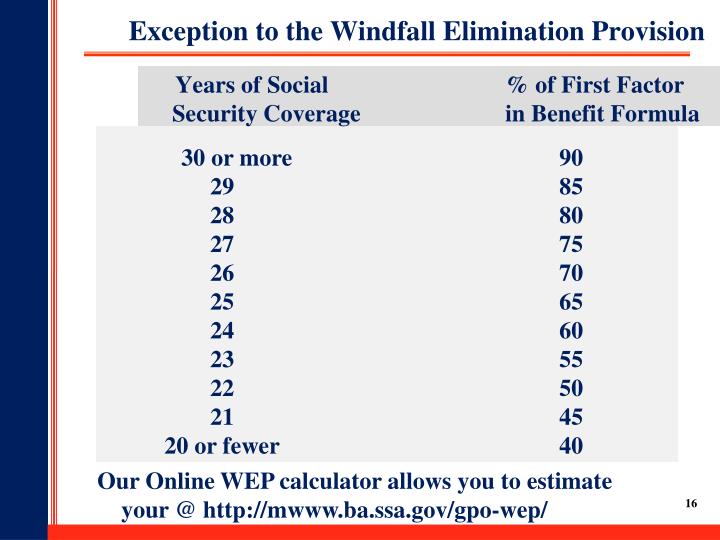

PPT Social Security PowerPoint Presentation ID1486761

The Best Explanation of the Windfall Elimination Provision (2023 Update) Social Security

Understanding CSRS Offset Retirement Pension and the Windfall Elimination Provision Federal

‘Windfall’ Provision Did Not Apply Unlike Some Government Pensions, Military Retirement Pay Was Not Subject To The Windfall Elimination Provision (Wep), So Former Service Members Did.

In December 2024, Congress Repealed The Windfall Elimination Provision (Wep) And The Government Pension Offset (Gpo), Ending Policies That For More Than Four Decades Reduced.

The United States Has International Agreements With Over 20 Foreign Countries For People Who Have Worked Abroad.

Related Post: