Vxus Chart

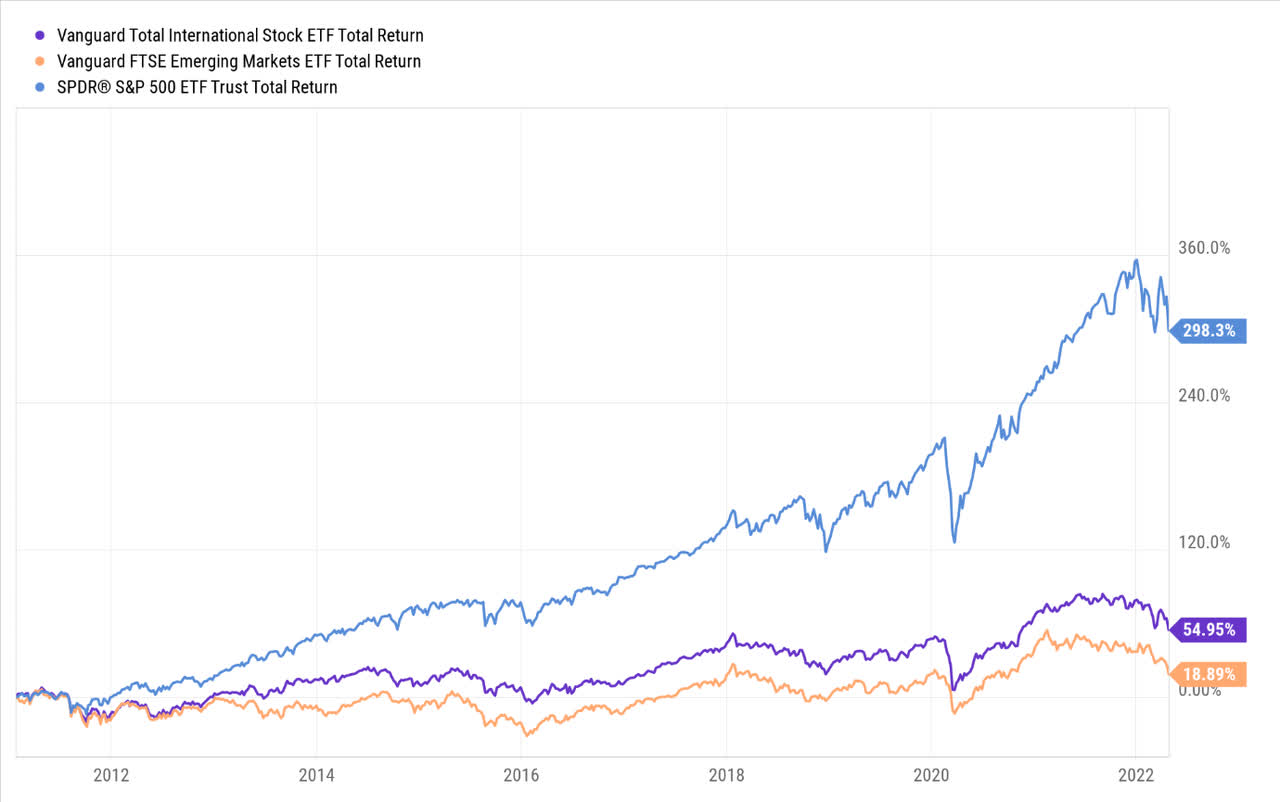

Vxus Chart - I wouldn't think too much on the issue. What is the rest of the world doing so different that makes investors pile into the united states markets like. Hello, i am researching on etf’s to put in my long term portfolio. 20% vxus seems like enough to get a diversification benefit. I’m converting my vxus holding in my roth to fidelity mutual funds. It makes sense that voo/vti and vxus track. For international exposure, i hold vxus in my roth and vea in my taxable account. Veu and vxus have nearly identical performance in their life times. I know many advocate for something like global market weight but having been so disappointed in foreign stocks this. Then again, it's the only canadian equity i own). Vxus is roughly 75% developed markets (excluding the us) + 25% emerging markets, so you can get a similar portfolio with a lower expense ratio at 60% vti + 30% vea + 10% vwo. For international exposure, i hold vxus in my roth and vea in my taxable account. 20% vxus seems like enough to get a diversification benefit. Veu is tilted towards large. What is the rest of the world doing so different that makes investors pile into the united states markets like. Then again, it's the only canadian equity i own). I know many advocate for something like global market weight but having been so disappointed in foreign stocks this. But why has it sucked??? It makes sense that voo/vti and vxus track. I understand that vti and voo are both very solid and. I wouldn't think too much on the issue. I’m converting my vxus holding in my roth to fidelity mutual funds. Should i just save myself the time and effort and dump the. 20% vxus seems like enough to get a diversification benefit. Hello, i am researching on etf’s to put in my long term portfolio. Vxus is heavily weighted in the canadian equity. Veu and vxus have nearly identical performance in their life times. I wouldn't think too much on the issue. I find myself rather addicted to the constant update of my portfolio and day trends that i’d rather just sit it and forget it. Veu is tilted towards large. Veu is tilted towards large. Hello, i am researching on etf’s to put in my long term portfolio. (incidentally, my least favorite thing about vxus. Everyone mentions vti, voo and vxus. For international exposure, i hold vxus in my roth and vea in my taxable account. We know why to invest in vxus: I’m converting my vxus holding in my roth to fidelity mutual funds. I understand that vti and voo are both very solid and. Vxus is heavily weighted in the canadian equity. But why has it sucked??? It makes sense that voo/vti and vxus track. I find myself rather addicted to the constant update of my portfolio and day trends that i’d rather just sit it and forget it. (incidentally, my least favorite thing about vxus. I understand that vti and voo are both very solid and. Veu is tilted towards large. 20% vxus seems like enough to get a diversification benefit. I wouldn't think too much on the issue. I’m converting my vxus holding in my roth to fidelity mutual funds. It makes sense that voo/vti and vxus track. (incidentally, my least favorite thing about vxus. Vxus is roughly 75% developed markets (excluding the us) + 25% emerging markets, so you can get a similar portfolio with a lower expense ratio at 60% vti + 30% vea + 10% vwo. Veu is tilted towards large. Vxus has twice as many companies as veu. Everyone mentions vti, voo and vxus. Veu and vxus have nearly identical performance. Currently have a vti and vxus allocation of around 30k with about 30k more to invest. Vxus has twice as many companies as veu. 20% vxus seems like enough to get a diversification benefit. Hello, i am researching on etf’s to put in my long term portfolio. I find myself rather addicted to the constant update of my portfolio and. Veu and vxus have nearly identical performance in their life times. Then again, it's the only canadian equity i own). Should i just save myself the time and effort and dump the. Vxus has twice as many companies as veu. I find myself rather addicted to the constant update of my portfolio and day trends that i’d rather just sit. What is the rest of the world doing so different that makes investors pile into the united states markets like. It makes sense that voo/vti and vxus track. I understand that vti and voo are both very solid and. 20% vxus seems like enough to get a diversification benefit. For international exposure, i hold vxus in my roth and vea. Veu is tilted towards large. I understand that vti and voo are both very solid and. Currently have a vti and vxus allocation of around 30k with about 30k more to invest. (incidentally, my least favorite thing about vxus. Veu and vxus have nearly identical performance in their life times. 20% vxus seems like enough to get a diversification benefit. But why has it sucked??? So far as i can tell, the two perform pretty much the same. What is the rest of the world doing so different that makes investors pile into the united states markets like. Everyone mentions vti, voo and vxus. I know many advocate for something like global market weight but having been so disappointed in foreign stocks this. Should i just save myself the time and effort and dump the. It makes sense that voo/vti and vxus track. I’m converting my vxus holding in my roth to fidelity mutual funds. Then again, it's the only canadian equity i own). Hello, i am researching on etf’s to put in my long term portfolio.Vanguard U.S. vs NonU.S. ETF Performance Update VTI vs VXUS

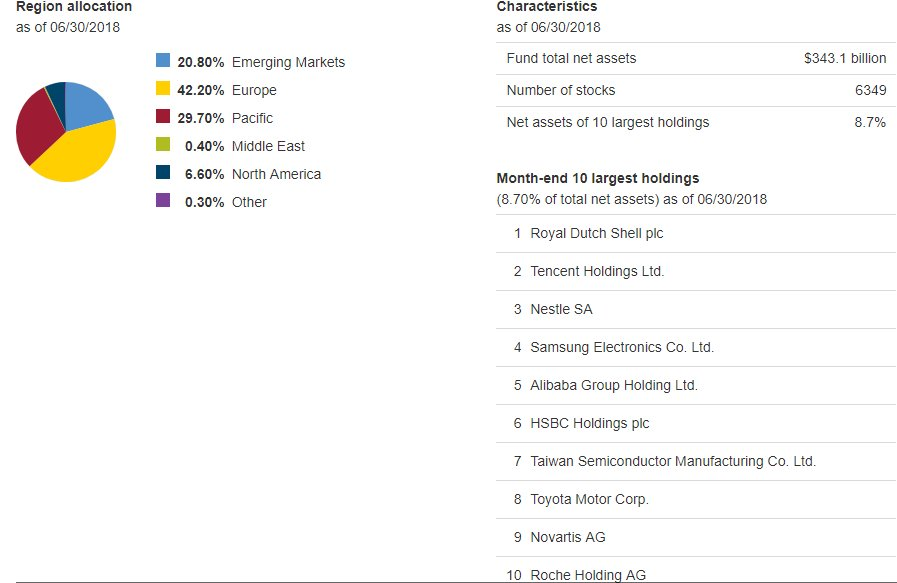

21 important things you should know about Vanguard VXUS ETF

Vanguard Total Internati... Chart VXUS ADVFN

VXUS Stock Fund Price and Chart — NASDAQVXUS — TradingView

In Search Of The Perfect Portfolio International Stock ETFs Vanguard Total International

VXUS Stock Fund Price and Chart — NASDAQVXUS — TradingView

VXUS Stock Fund Price and Chart — NASDAQVXUS — TradingView

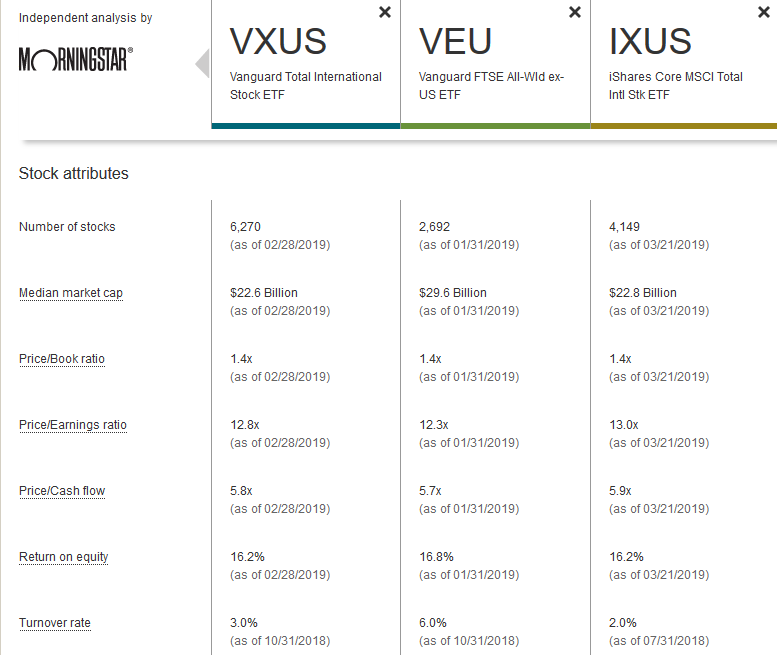

VEU vs VXUS Which is the Best International ETF? The Frugal Expat

VXUS Vs. VWO The Differences And Which Is The Better Buy Seeking Alpha

VTI vs. VXUS Which Fund Should You Invest In? Four Pillar Freedom

Vxus Has Twice As Many Companies As Veu.

We Know Why To Invest In Vxus:

Vxus Is Roughly 75% Developed Markets (Excluding The Us) + 25% Emerging Markets, So You Can Get A Similar Portfolio With A Lower Expense Ratio At 60% Vti + 30% Vea + 10% Vwo.

I Find Myself Rather Addicted To The Constant Update Of My Portfolio And Day Trends That I’d Rather Just Sit It And Forget It.

Related Post: