Qqqm Chart

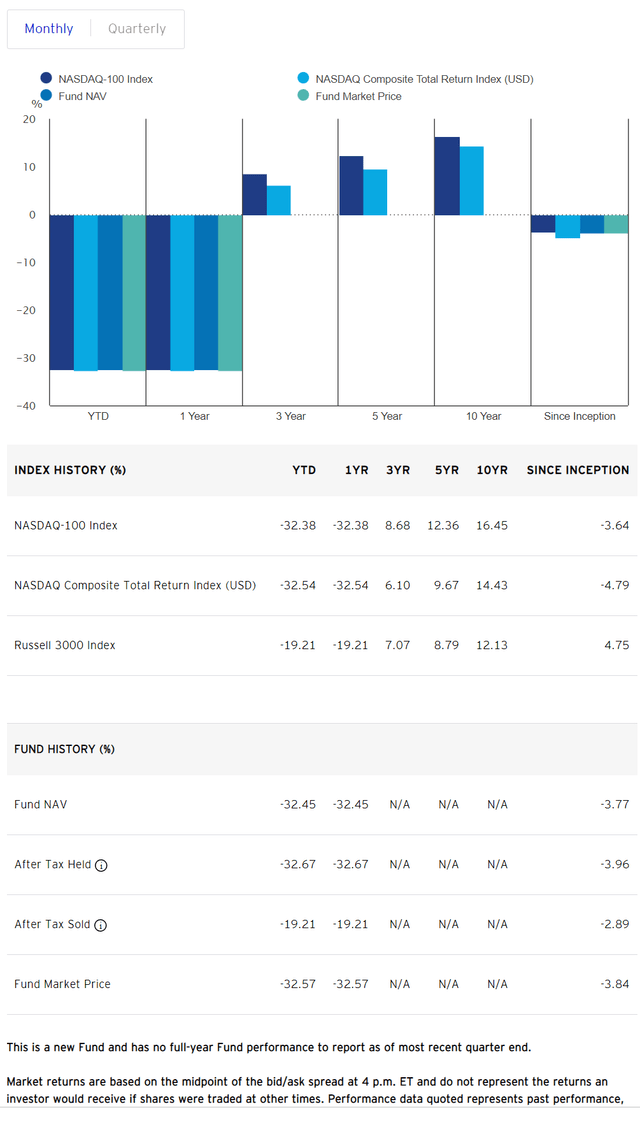

Qqqm Chart - The difference is 5 basis points. However, it's subject to more volatility than broader market indices like voo. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? In my portfolio i currently invest in voo and schd. It's obviously the same thing as qqq which has existed for 25 years. I have been researching more etf's to add a third to my account. They are the same thing. Qqqm is up less only because it is younger, less than five years old. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. The only difference is qqq cost 0.20%. Qqqm offers good sector diversification, primarily in tech, and has historically shown strong growth. Qqqm has been treating me very nicely since i purchased it a few weeks ago. I only started investing for the first time about a year ago and have been buying almost exclusively qqq. Just that qqqm inception was october 2020. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. I have around 60% voo and 40% schd. Qqqm is up less only because it is younger, less than five years old. I have been researching more etf's to add a third to my account. The only difference is qqq cost 0.20%. It's obviously the same thing as qqq which has existed for 25 years. I have around 60% voo and 40% schd. The only difference is qqq cost 0.20%. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. The difference is 5 basis points. However, it's subject to more volatility than broader market indices like voo. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. It's obviously the same thing as qqq which has existed for 25 years. However, it's subject to more volatility than broader market indices like voo. I. They are exactly the same. In my portfolio i currently invest in voo and schd. Qqqm has been treating me very nicely since i purchased it a few weeks ago. I have around 60% voo and 40% schd. Qqqm is up less only because it is younger, less than five years old. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. Searched extensively about qqqm vs qqq and the only difference i could find was that qqqm was slightly better in terms of lower expense ratio. It's obviously the same thing as qqq which has existed for 25 years. If you ignore past performance, why is it a good idea to put your money in qqq/qqqm at all? I have been researching more etf's to add a third to my account. The only difference is qqq cost 0.20%. However, it's subject to more volatility than broader. It's obviously the same thing as qqq which has existed for 25 years. Qqqm offers good sector diversification, primarily in tech, and has historically shown strong growth. They are the same thing. The only difference is qqq cost 0.20%. Qqqm is up less only because it is younger, less than five years old. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. In my portfolio i currently invest in voo and schd. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. It's obviously the same thing as qqq which has existed for 25 years. The difference is. I only started investing for the first time about a year ago and have been buying almost exclusively qqq. It's obviously the same thing as qqq which has existed for 25 years. In my portfolio i currently invest in voo and schd. Just that qqqm inception was october 2020. They are the same thing. I only started investing for the first time about a year ago and have been buying almost exclusively qqq. Qqqm has been treating me very nicely since i purchased it a few weeks ago. However, it's subject to more volatility than broader market indices like voo. It's obviously the same thing as qqq which has existed for 25 years. I. They are the same thing. Qqqm has been treating me very nicely since i purchased it a few weeks ago. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. Just that qqqm inception was october 2020. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%. Just that qqqm inception was october 2020. It's obviously the same thing as qqq which has existed for 25 years. The only difference is qqq cost 0.20%. Qqqm itself has only existed for 4 years and in that 4 years it's slightly underperformed the market. However, it's subject to more volatility than broader market indices like voo. Searched extensively about qqqm vs qqq and the only difference i could find was that qqqm was slightly better in terms of lower expense ratio and composition is a bit. In my portfolio i currently invest in voo and schd. The difference is 5 basis points. Qqqm offers good sector diversification, primarily in tech, and has historically shown strong growth. Intuitively, if you want growth, putting your money in a broader index etf like spyg, vug,. I have been researching more etf's to add a third to my account. I only started investing for the first time about a year ago and have been buying almost exclusively qqq. Qqqm is up less only because it is younger, less than five years old. They are the same thing. Since qqqm was founded in october 2020 its total return is +52.16% while qqq's is 51.86%.QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

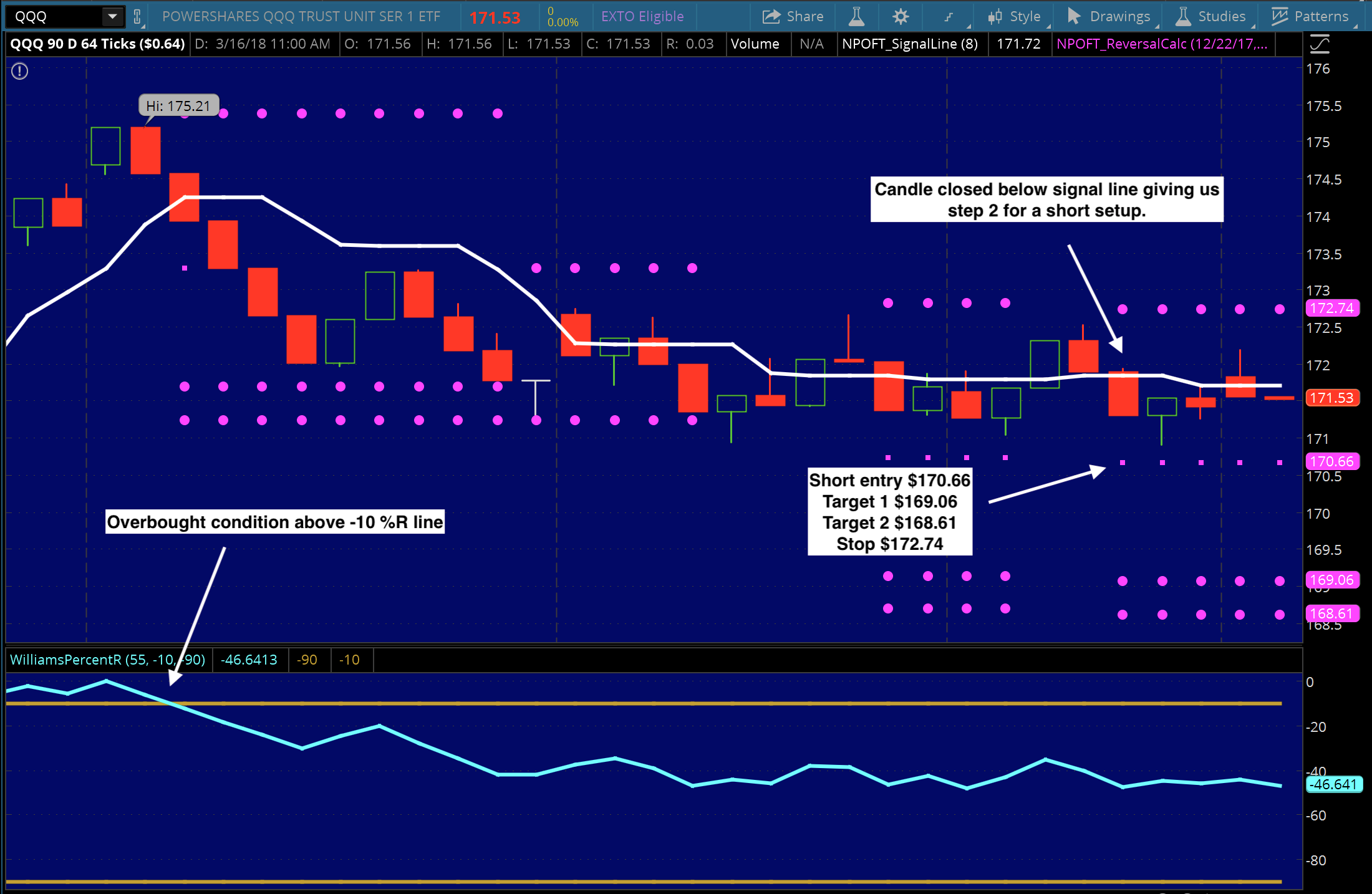

Comparing Nasdaq 100 ETFs RealLife Examples with QQQ & QQQM Forex Systems, Research, And Reviews

Qqq Options Chart A Visual Reference of Charts Chart Master

【美股入門】QQQM (Invesco NASDAQ 100 ETF) QQQ之外的另一個選擇! QQQM 好嗎? 可以買嗎? QQQ vs. QQQM 有何不同? 聰明主婦の生活投資學

Invesco NASDAQ 100 ETF Worthwhile To Switch From QQQ (NASDAQQQQM) Seeking Alpha

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

QQQM Stock Fund Price and Chart — NASDAQQQQM — TradingView

QQQM (Invesco NASDAQ 100 ETF) Technical Charts and Market Data TrendSpider

Invesco NASDAQ 100 ETF Chart QQQM ADVFN

If You Ignore Past Performance, Why Is It A Good Idea To Put Your Money In Qqq/Qqqm At All?

They Are Exactly The Same.

I Have Around 60% Voo And 40% Schd.

Qqqm Has Been Treating Me Very Nicely Since I Purchased It A Few Weeks Ago.

Related Post: