Irr Chart

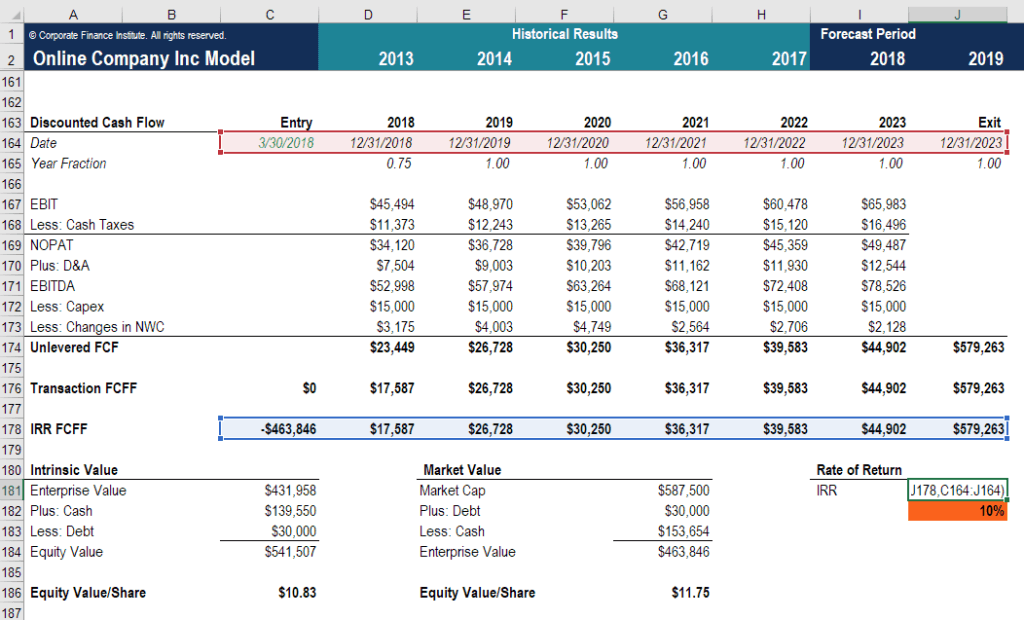

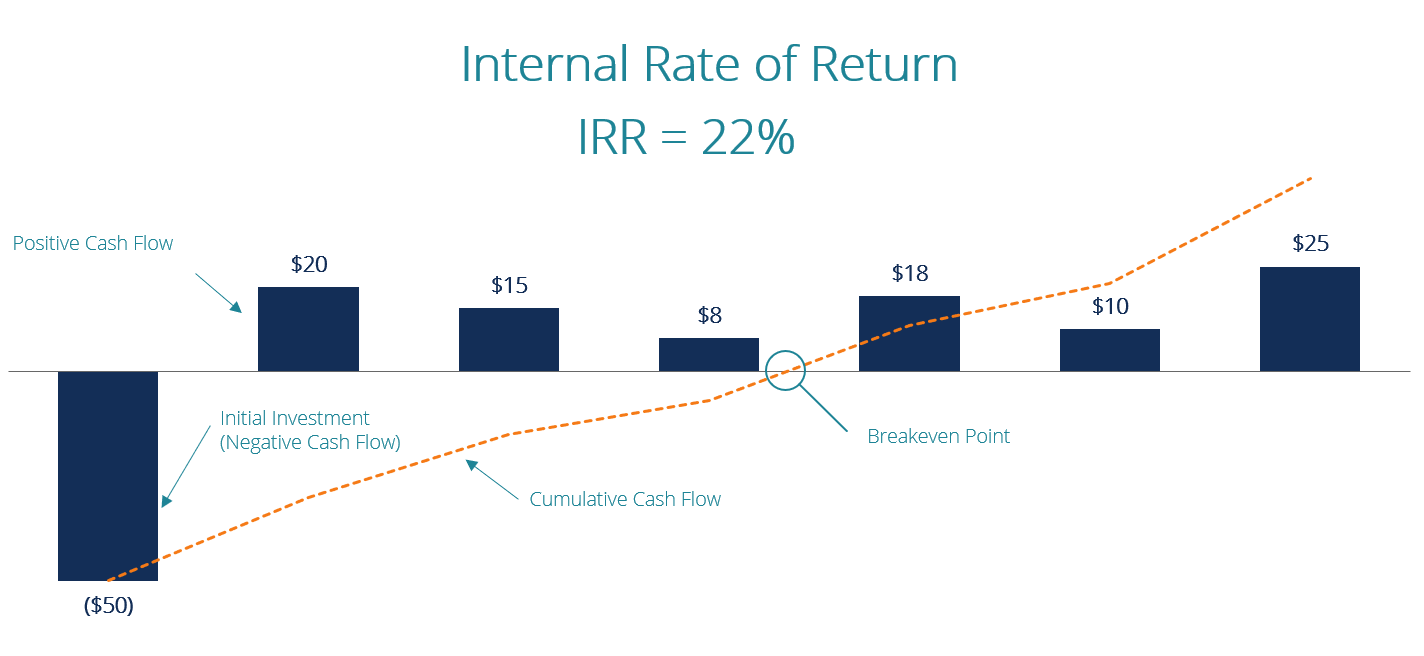

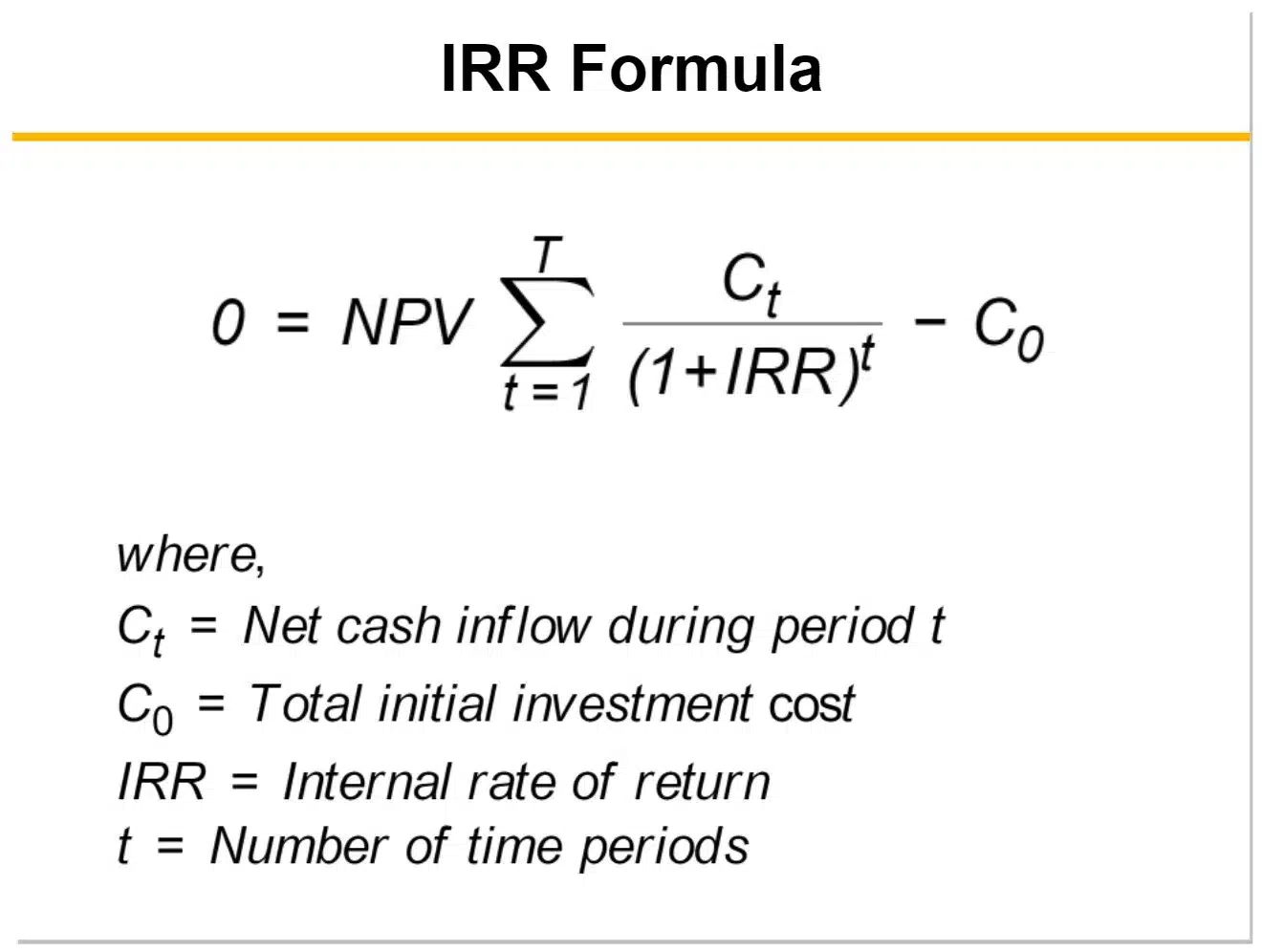

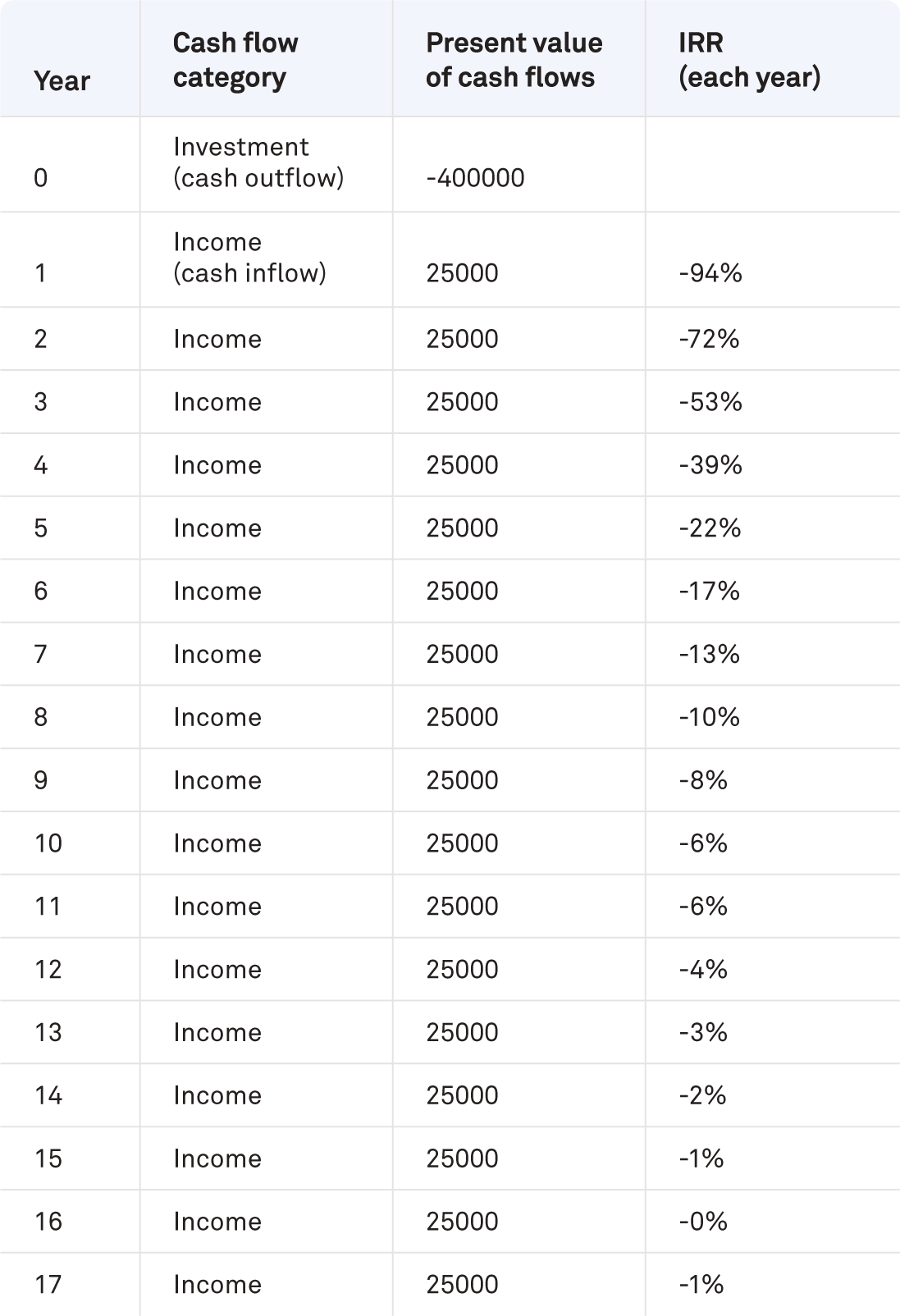

Irr Chart - While wacc measures the cost of operations through financing, the internal rate of. Companies often use internal rate of return (irr) to determine whether an. What is a debt service coverage ratio (dscr)? Our easy guide shows you how to find irr on a financial calculator or in excel. Calculating irr might seem tricky for multiple cash flow periods. What is the meaning of irr? A hurdle rate is the 'line in the sand' that helps companies decide whether to pursue projects. What is compound annual growth rate? Unannualized refers to a rate of return or other measure for a period that is not one year. Our financial experts use internal rate of return examples to teach you how to calculate irr with ease. Unannualized refers to a rate of return or other measure for a period that is not one year. A company's debt service coverage ratio (dscr) refers to its ability to meet periodic obligations on outstanding liabilities. While wacc measures the cost of operations through financing, the internal rate of. Irr wacc and internal rate of return (irr) measure two different concepts. Companies often use internal rate of return (irr) to determine whether an. It doesn’t have to be difficult to calculate yield to maturity. What is a debt service coverage ratio (dscr)? Rolling returns are the returns on an investment measured over several periods. What is the meaning of irr? What is compound annual growth rate? What is compound annual growth rate? What is the meaning of irr? Unannualized refers to a rate of return or other measure for a period that is not one year. Calculating irr might seem tricky for multiple cash flow periods. Our easy guide shows you how to find irr on a financial calculator or in excel. Our easy guide shows you how to find irr on a financial calculator or in excel. What is compound annual growth rate? It doesn’t have to be difficult to calculate yield to maturity. Our financial experts use internal rate of return examples to teach you how to calculate irr with ease. A hurdle rate is the 'line in the sand'. Irr wacc and internal rate of return (irr) measure two different concepts. What is a debt service coverage ratio (dscr)? Companies often use internal rate of return (irr) to determine whether an. Calculating irr might seem tricky for multiple cash flow periods. A company's debt service coverage ratio (dscr) refers to its ability to meet periodic obligations on outstanding liabilities. What is a debt service coverage ratio (dscr)? Rolling returns are the returns on an investment measured over several periods. What is compound annual growth rate? A hurdle rate is the 'line in the sand' that helps companies decide whether to pursue projects. Calculating irr might seem tricky for multiple cash flow periods. It doesn’t have to be difficult to calculate yield to maturity. Our financial experts use internal rate of return examples to teach you how to calculate irr with ease. Unannualized refers to a rate of return or other measure for a period that is not one year. Rolling returns are the returns on an investment measured over several periods. Calculating. Irr is not the only capital budgeting method (net present value and discounted cash flow are other methods), it is just an example of why capital budgeting exists. Unannualized refers to a rate of return or other measure for a period that is not one year. While wacc measures the cost of operations through financing, the internal rate of. Our. Our financial experts use internal rate of return examples to teach you how to calculate irr with ease. A hurdle rate is the 'line in the sand' that helps companies decide whether to pursue projects. Rolling returns are the returns on an investment measured over several periods. Our easy guide shows you how to find irr on a financial calculator. Calculating irr might seem tricky for multiple cash flow periods. Companies often use internal rate of return (irr) to determine whether an. What is the meaning of irr? A company's debt service coverage ratio (dscr) refers to its ability to meet periodic obligations on outstanding liabilities. Irr is not the only capital budgeting method (net present value and discounted cash. Companies often use internal rate of return (irr) to determine whether an. It doesn’t have to be difficult to calculate yield to maturity. Calculating irr might seem tricky for multiple cash flow periods. Unannualized refers to a rate of return or other measure for a period that is not one year. While wacc measures the cost of operations through financing,. Irr is not the only capital budgeting method (net present value and discounted cash flow are other methods), it is just an example of why capital budgeting exists. What is the meaning of irr? While wacc measures the cost of operations through financing, the internal rate of. What is compound annual growth rate? It doesn’t have to be difficult to. While wacc measures the cost of operations through financing, the internal rate of. What is a debt service coverage ratio (dscr)? What is the meaning of irr? Rolling returns are the returns on an investment measured over several periods. What is compound annual growth rate? A hurdle rate is the 'line in the sand' that helps companies decide whether to pursue projects. Our easy guide shows you how to find irr on a financial calculator or in excel. Calculating irr might seem tricky for multiple cash flow periods. A company's debt service coverage ratio (dscr) refers to its ability to meet periodic obligations on outstanding liabilities. Our financial experts use internal rate of return examples to teach you how to calculate irr with ease. Unannualized refers to a rate of return or other measure for a period that is not one year. It doesn’t have to be difficult to calculate yield to maturity.Internal rate of return (IRR) What is, calculation and examples

Internal Rate of Return (IRR) How to use the IRR Formula

Internal Rate of Return (IRR) How to use the IRR Formula

Rule of 72 (How to Quickly Calculate IRR)

Internal Rate of Return (IRR) Definition, Formula & Example

How To Calculate IRR StepbyStep Walkthrough

Internal Rate of Return (IRR) Formula What It Is and How to Use It 2023 Bungalow

Jackie's Point of View How to calculate Internal Rate of Return (IRR)? (Critical Review)

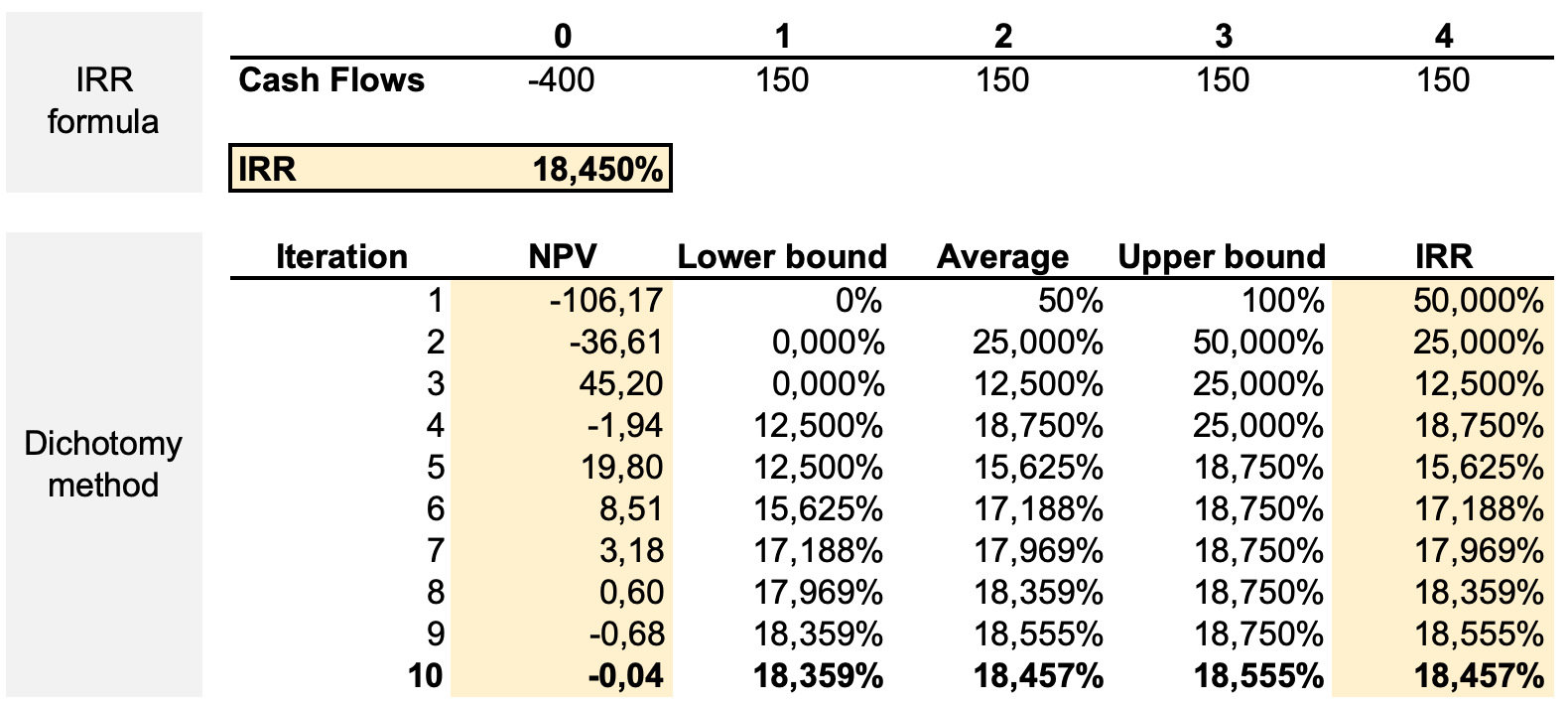

The Internal Rate of Return SimTrade blog

Internal rate of return (IRR) What is, calculation and examples

Companies Often Use Internal Rate Of Return (Irr) To Determine Whether An.

Irr Is Not The Only Capital Budgeting Method (Net Present Value And Discounted Cash Flow Are Other Methods), It Is Just An Example Of Why Capital Budgeting Exists.

Irr Wacc And Internal Rate Of Return (Irr) Measure Two Different Concepts.

Related Post: