Ira Vs 403B Comparison Chart

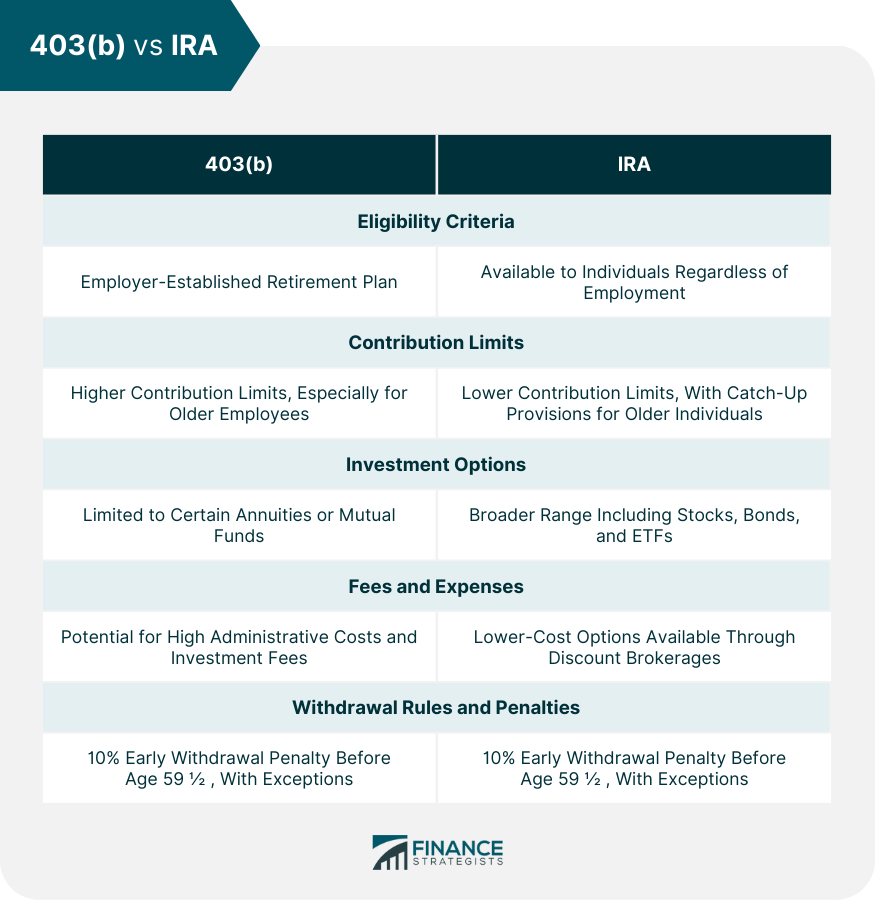

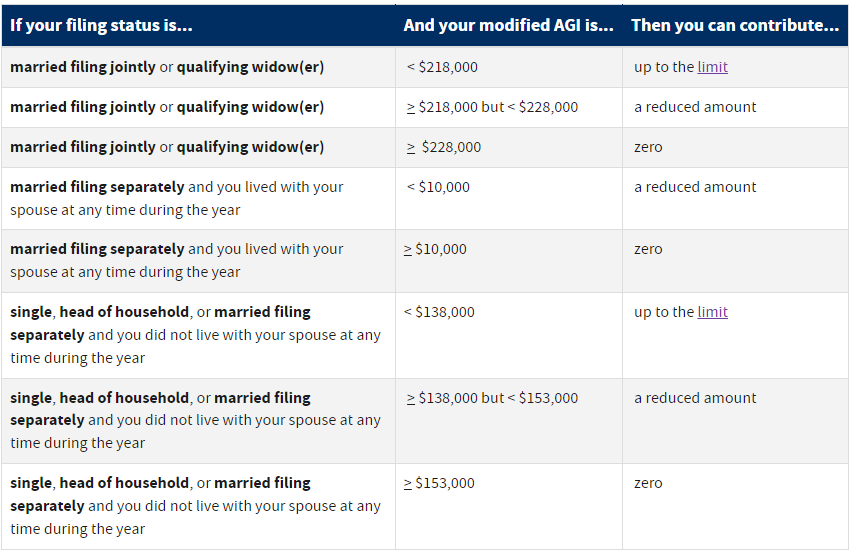

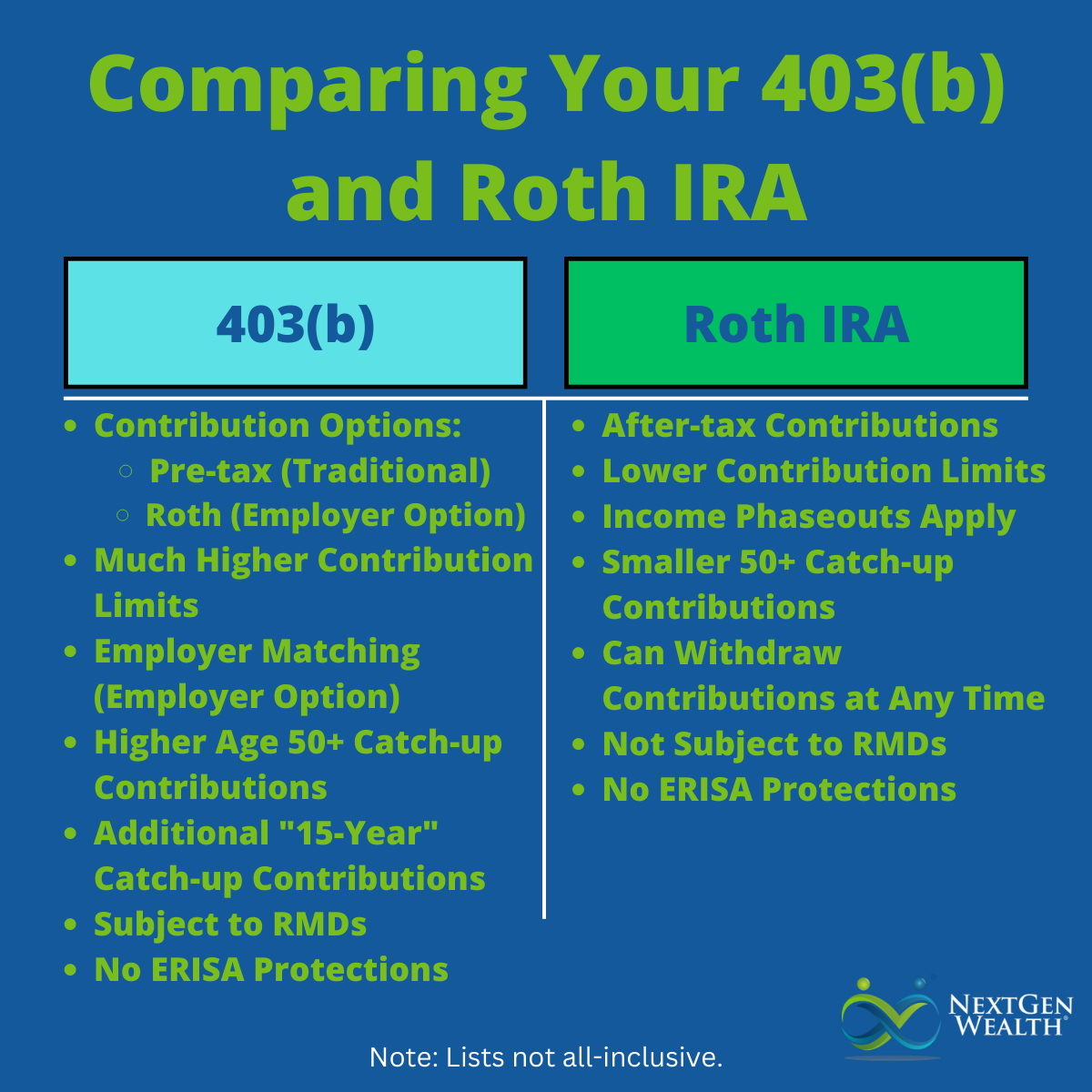

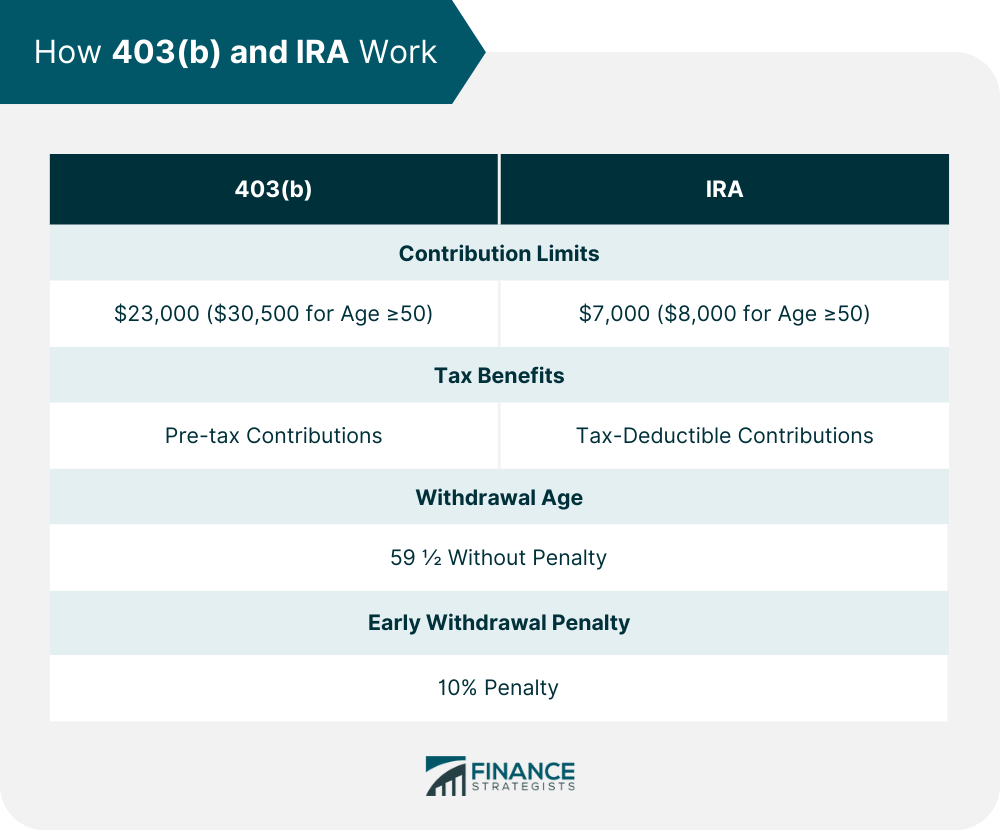

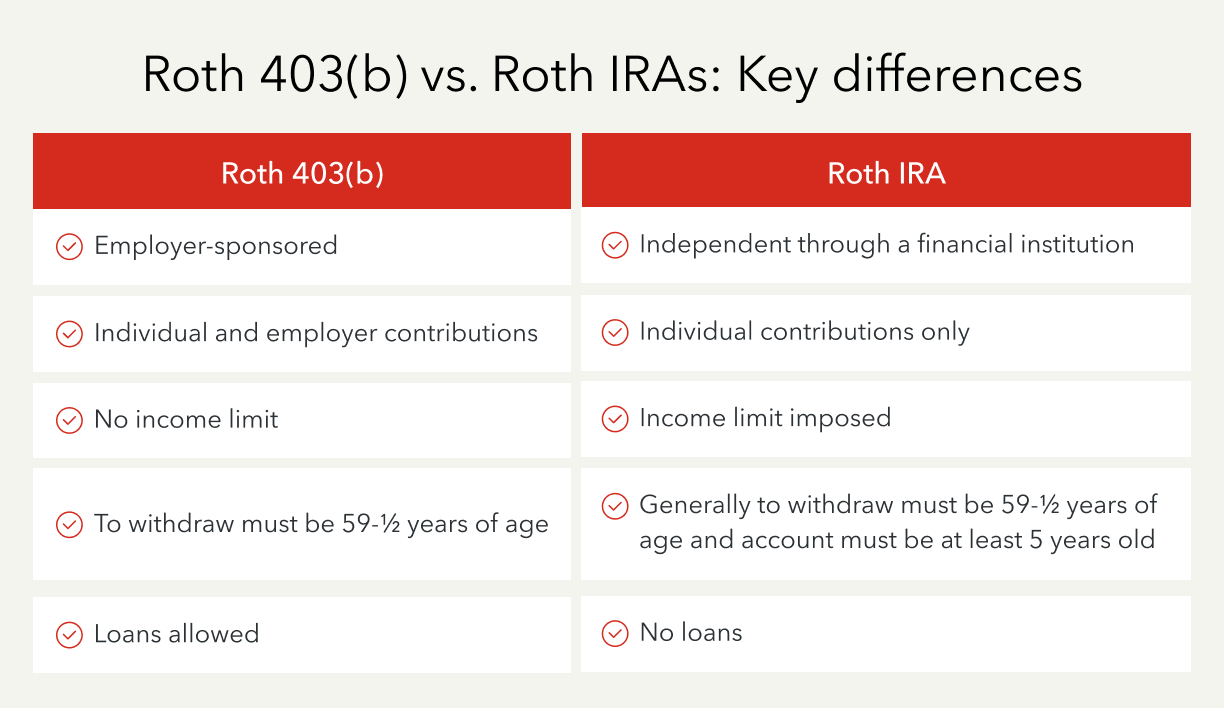

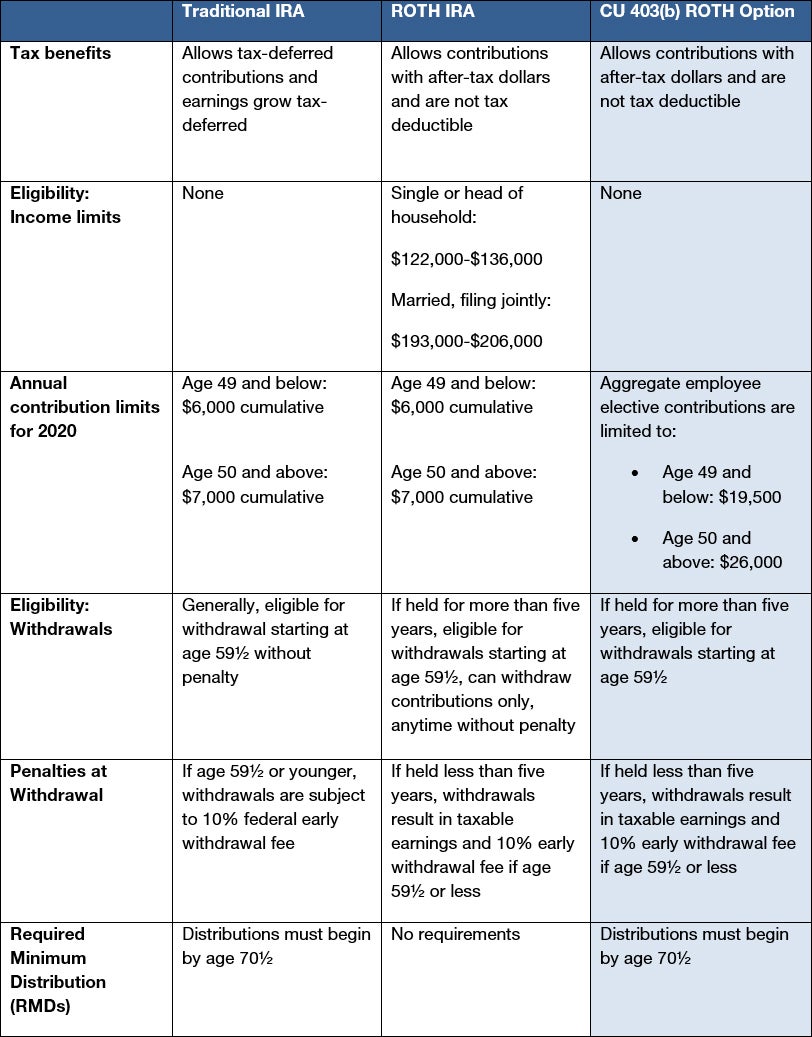

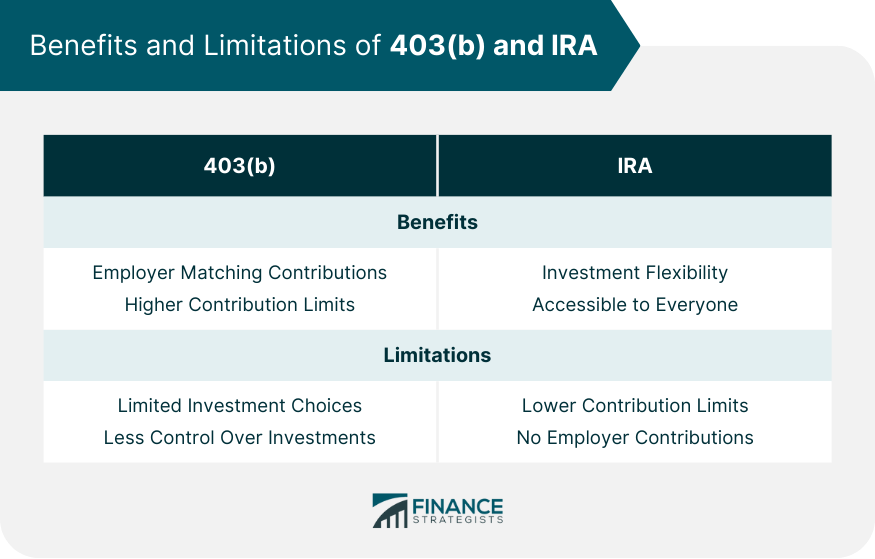

Ira Vs 403B Comparison Chart - A 403 (b) is offered. Choosing between a 403 (b) and an ira will depend on your employment situation, financial goals, and investment preferences. Review a required minimum distribution table that compares iras and defined contribution plans, such as 401 (k), profit sharing and 403 (b) plans. A 403 (b) is offered by public. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. Understand contribution limits, tax benefits, investment options, withdrawal rules, and when to choose each. Here are the key differences between 403 (b) plans and roth iras. But that’s about where the similarities. 403 (b)s and roth iras are both retirement accounts that can help you grow your retirement savings while benefiting from tax advantages. Note that distributions from the roth 403(b) and roth ira are subject to taxation on the portion attributable to earnings if. Employees of qualifying nonprofit organizations and public schools whose employers offer 403 (b) plans. Note that distributions from the roth 403(b) and roth ira are subject to taxation on the portion attributable to earnings if. Compare traditional iras and 403 (b) plans to understand their tax benefits, investment options, and withdrawal rules, helping you make informed retirement decisions. Here are the key differences between 403 (b) plans and roth iras. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. A 403 (b) is offered by public. Choosing between a 403 (b) and an ira will depend on your employment situation, financial goals, and investment preferences. Understand contribution limits, tax benefits, investment options, withdrawal rules, and when to choose each. A 403 (b) is offered. Be sure to consult with a financial. But that’s about where the similarities. Review a required minimum distribution table that compares iras and defined contribution plans, such as 401 (k), profit sharing and 403 (b) plans. Here are the key differences between 403 (b) plans and roth iras. Note that distributions from the roth 403(b) and roth ira are subject to taxation on the portion attributable to. Employees of qualifying nonprofit organizations and public schools whose employers offer 403 (b) plans. A 403 (b) is offered by public. Compare traditional iras and 403 (b) plans to understand their tax benefits, investment options, and withdrawal rules, helping you make informed retirement decisions. Note that distributions from the roth 403(b) and roth ira are subject to taxation on the. A 403 (b) is offered by public. Compare traditional iras and 403 (b) plans to understand their tax benefits, investment options, and withdrawal rules, helping you make informed retirement decisions. Employees of qualifying nonprofit organizations and public schools whose employers offer 403 (b) plans. Choosing between a 403 (b) and an ira will depend on your employment situation, financial goals,. Compare traditional iras and 403 (b) plans to understand their tax benefits, investment options, and withdrawal rules, helping you make informed retirement decisions. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. But that’s about where the similarities. Review a required minimum distribution table that compares iras and defined contribution plans,. Review a required minimum distribution table that compares iras and defined contribution plans, such as 401 (k), profit sharing and 403 (b) plans. Here are the key differences between 403 (b) plans and roth iras. Employees of qualifying nonprofit organizations and public schools whose employers offer 403 (b) plans. Choosing between a 403 (b) and an ira will depend on. Note that distributions from the roth 403(b) and roth ira are subject to taxation on the portion attributable to earnings if. Choosing between a 403 (b) and an ira will depend on your employment situation, financial goals, and investment preferences. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. A 403. Be sure to consult with a financial. 403 (b)s and roth iras are both retirement accounts that can help you grow your retirement savings while benefiting from tax advantages. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. Review a required minimum distribution table that compares iras and defined contribution plans,. A 403 (b) is offered. Here are the key differences between 403 (b) plans and roth iras. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. Review a required minimum distribution table that compares iras and defined contribution plans, such as 401 (k), profit sharing and 403 (b) plans. Compare traditional. Here are the key differences between 403 (b) plans and roth iras. Choosing between a 403 (b) and an ira will depend on your employment situation, financial goals, and investment preferences. Be sure to consult with a financial. Compare traditional iras and 403 (b) plans to understand their tax benefits, investment options, and withdrawal rules, helping you make informed retirement. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. Be sure to consult with a financial. But that’s about where the similarities. Compare traditional iras and 403 (b) plans to understand their tax benefits, investment options, and withdrawal rules, helping you make informed retirement decisions. Review a required minimum distribution table. Note that distributions from the roth 403(b) and roth ira are subject to taxation on the portion attributable to earnings if. Employees of qualifying nonprofit organizations and public schools whose employers offer 403 (b) plans. Review a required minimum distribution table that compares iras and defined contribution plans, such as 401 (k), profit sharing and 403 (b) plans. Understand contribution limits, tax benefits, investment options, withdrawal rules, and when to choose each. A 403 (b) is offered. Here are the key differences between 403 (b) plans and roth iras. There are many ways to save for retirement, but roth iras and 403 (b) plans are popular options. Be sure to consult with a financial. Choosing between a 403 (b) and an ira will depend on your employment situation, financial goals, and investment preferences. 403 (b)s and roth iras are both retirement accounts that can help you grow your retirement savings while benefiting from tax advantages.403(b) Annuity Rollover to IRA Why Consider, Eligibility, Guide

403(b) vs Roth IRA Which Plan is Right for You?

Traditional 403(b) or Roth IRA?

403(b) vs IRA Overview, How They Work, Benefits, Limitations

403b vs. Roth IRA Understanding Your Investment Options Intuit TurboTax Blog

Roth IRA Vs 403b Which Is The Best Retirment Plan?

Ira Vs 403b Comparison Chart Cu’s New 403(b) Roth Option E

Roth IRA vs. 403b Which is Better? (2022)

403(b) vs IRA Overview, How They Work, Benefits, Limitations

Roth IRA vs. 403b Which is Better? (2025)

Compare Traditional Iras And 403 (B) Plans To Understand Their Tax Benefits, Investment Options, And Withdrawal Rules, Helping You Make Informed Retirement Decisions.

A 403 (B) Is Offered By Public.

But That’s About Where The Similarities.

Related Post: