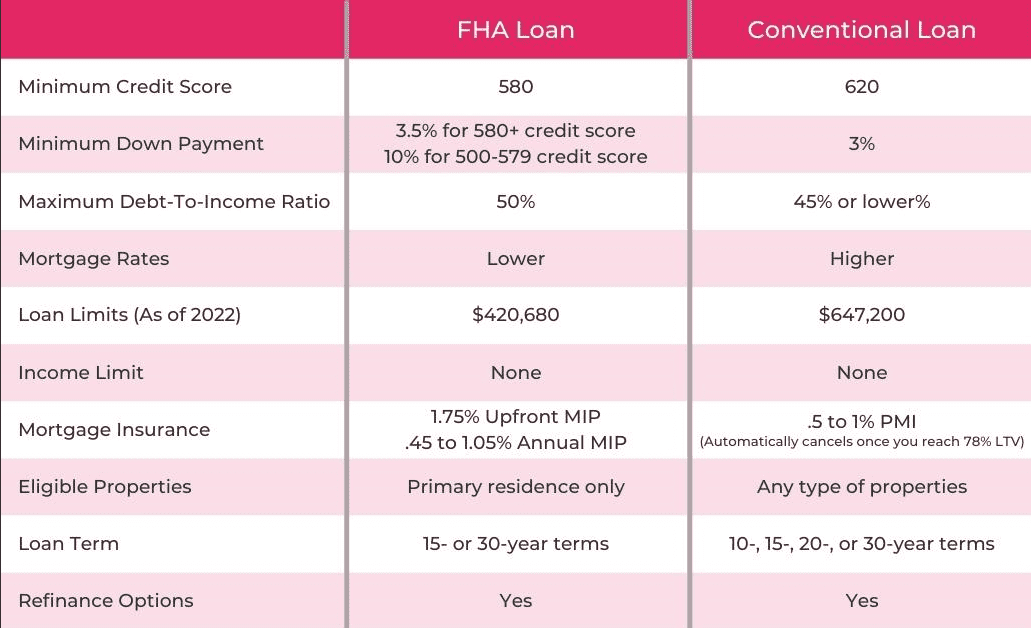

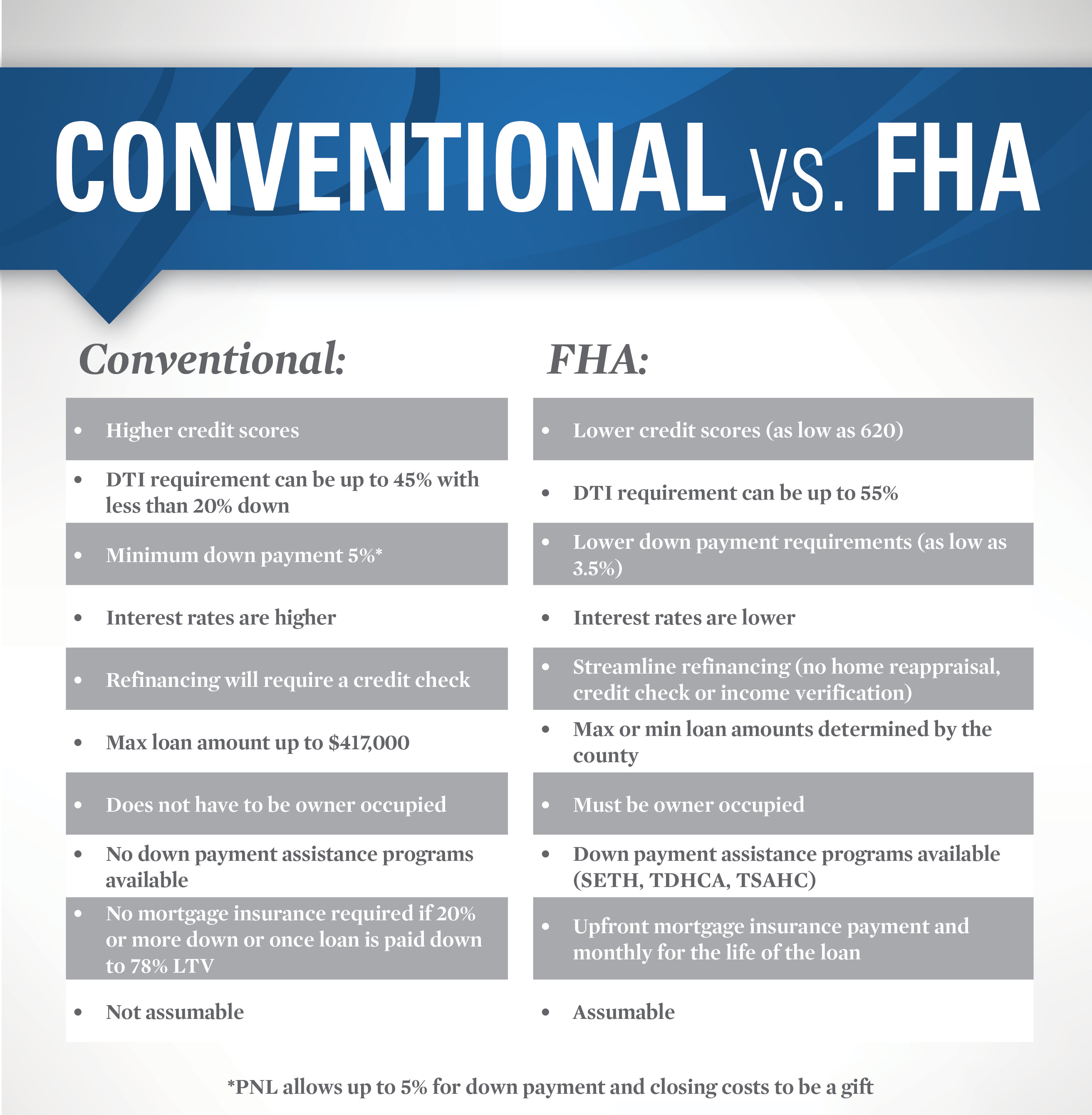

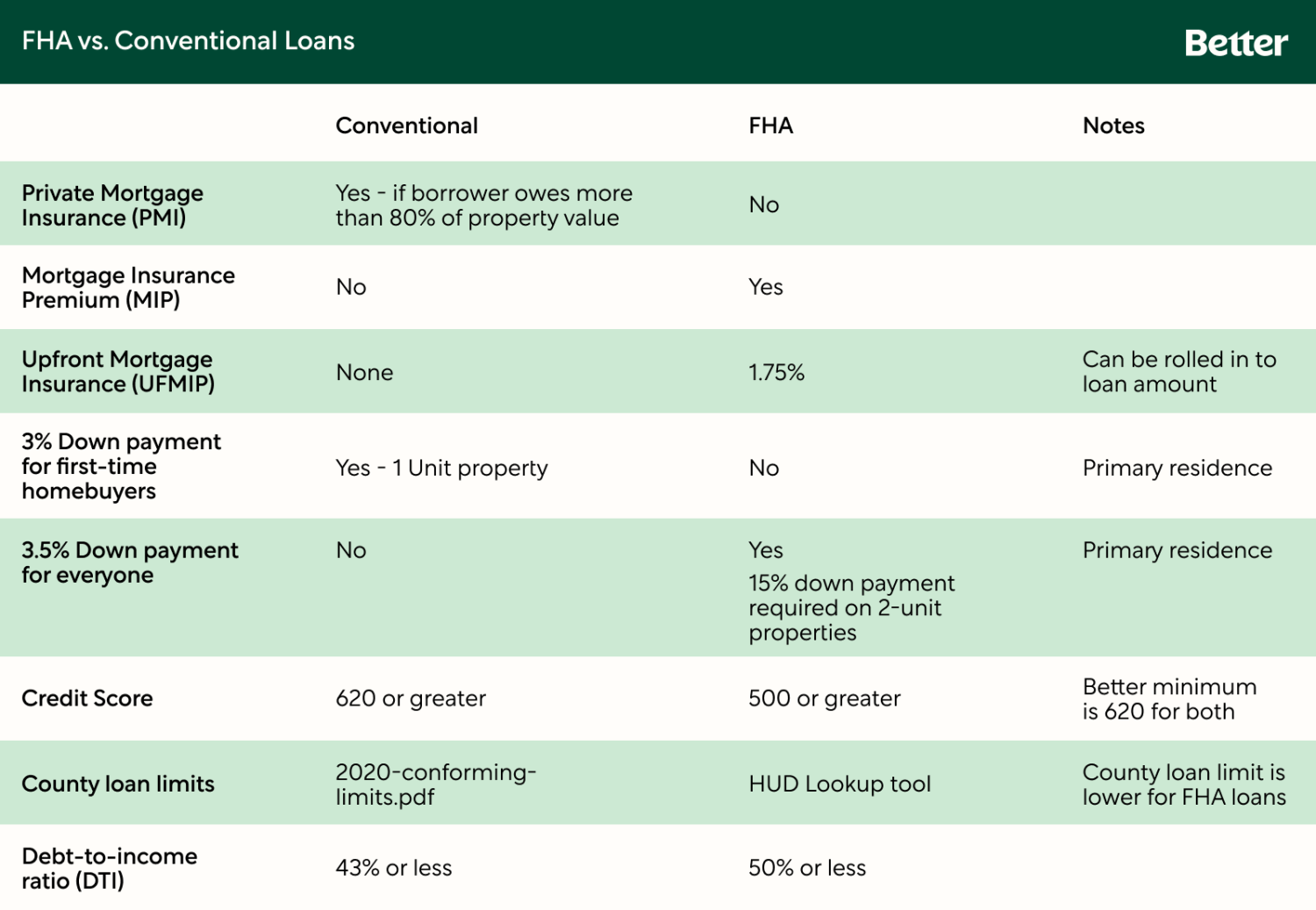

Fha Vs Conventional Comparison Chart

Fha Vs Conventional Comparison Chart - Find the better loan for your budget. Which mortgage loan is right for you? The defining difference between an fha vs conventional loan is that with an fha loan, the mortgage is insured by the federal housing administration while a conventional loan. This guide dives into rates, requirements,. Get approved todayget preapproved today skip the bankstart your mortgage If you’re shopping for a mortgage in 2025, it’s essential to understand the key differences between fha and conventional loans. Fha loans to help you decide which mortgage better suits your finances and chances for approval. Enter the property's fair market value, or the price you expect. If you have a lower credit score or limited savings, an fha loan might be the right choice. Here are the factors to weigh when considering an fha loan versus a conventional loan. Which mortgage loan is right for you? We’ve also included a comparison chart between the two types of loans at the end of the blog. Discover the pros and cons of conventional loan vs fha loan options in our comprehensive guide. Get approved todayget preapproved today skip the bankstart your mortgage While both mortgage types are available through banks, credit unions and private mortgage lenders, we’ve broken down the differences below to help you sort through which is. Here’s information to help you with the pros and cons of fha loans and conventional mortgages. If you have a lower credit score or limited savings, an fha loan might be the right choice. The defining difference between an fha vs conventional loan is that with an fha loan, the mortgage is insured by the federal housing administration while a conventional loan. If you’re shopping for a mortgage in 2025, it’s essential to understand the key differences between fha and conventional loans. Find the better loan for your budget. Compare both fha and conventional mortgage programs to get proper understanding of your situation. Here’s a breakdown of conventional loans vs. Which mortgage loan is right for you? If you have a lower credit score or limited savings, an fha loan might be the right choice. Here are the factors to weigh when considering an fha loan versus a conventional. Which mortgage loan is right for you? If you have a lower credit score or limited savings, an fha loan might be the right choice. Find the better loan for your budget. Get approved todayget preapproved today skip the bankstart your mortgage This guide dives into rates, requirements,. Enter the property's fair market value, or the price you expect. Here are the factors to weigh when considering an fha loan versus a conventional loan. Here’s information to help you with the pros and cons of fha loans and conventional mortgages. Discover the pros and cons of conventional loan vs fha loan options in our comprehensive guide. Compare both. If you’re shopping for a mortgage in 2025, it’s essential to understand the key differences between fha and conventional loans. Which mortgage loan is right for you? This guide dives into rates, requirements,. Enter the property's fair market value, or the price you expect. Here are the factors to weigh when considering an fha loan versus a conventional loan. Find the better loan for your budget. Compare both fha and conventional mortgage programs to get proper understanding of your situation. Here’s a breakdown of conventional loans vs. The defining difference between an fha vs conventional loan is that with an fha loan, the mortgage is insured by the federal housing administration while a conventional loan. This guide dives into. The defining difference between an fha vs conventional loan is that with an fha loan, the mortgage is insured by the federal housing administration while a conventional loan. Find the better loan for your budget. Get approved todayget preapproved today skip the bankstart your mortgage Which mortgage loan is right for you? Fha loans to help you decide which mortgage. Here’s information to help you with the pros and cons of fha loans and conventional mortgages. If you’re shopping for a mortgage in 2025, it’s essential to understand the key differences between fha and conventional loans. The defining difference between an fha vs conventional loan is that with an fha loan, the mortgage is insured by the federal housing administration. Enter the property's fair market value, or the price you expect. Here’s a breakdown of conventional loans vs. Discover the pros and cons of conventional loan vs fha loan options in our comprehensive guide. Fha loans to help you decide which mortgage better suits your finances and chances for approval. If you’re shopping for a mortgage in 2025, it’s essential. However, if you have a stronger credit score and can afford a larger down payment, a. If you have a lower credit score or limited savings, an fha loan might be the right choice. Enter the property's fair market value, or the price you expect. Here’s information to help you with the pros and cons of fha loans and conventional. While both mortgage types are available through banks, credit unions and private mortgage lenders, we’ve broken down the differences below to help you sort through which is. Find the better loan for your budget. Compare both fha and conventional mortgage programs to get proper understanding of your situation. The defining difference between an fha vs conventional loan is that with. Here are the factors to weigh when considering an fha loan versus a conventional loan. This guide dives into rates, requirements,. Get approved todayget preapproved today skip the bankstart your mortgage Fha loans to help you decide which mortgage better suits your finances and chances for approval. Here’s information to help you with the pros and cons of fha loans and conventional mortgages. However, if you have a stronger credit score and can afford a larger down payment, a. We’ve also included a comparison chart between the two types of loans at the end of the blog. The defining difference between an fha vs conventional loan is that with an fha loan, the mortgage is insured by the federal housing administration while a conventional loan. Here’s a breakdown of conventional loans vs. Enter the property's fair market value, or the price you expect. If you have a lower credit score or limited savings, an fha loan might be the right choice. Which mortgage loan is right for you? While both mortgage types are available through banks, credit unions and private mortgage lenders, we’ve broken down the differences below to help you sort through which is.FHA Loans vs. Conventional Loans What’s the Difference?

fha vs conventional comparison chart Conventional fha better mortgage loans divisi

fha vs conventional comparison chart Conventional fha better mortgage loans divisi

Difference Between FHA and Conventional Mortgage Your Mortgage Guy For Life

Fha Vs Conventional Comparison Chart A Visual Reference of Charts Chart Master

FHA vs Conventional Loans A Full Breakdown of Each Loan Type Better Mortgage

FHA vs Conventional Loan 2025 Rates & Differences

FHA vs Conventional Loans How to Choose [Updated for 2018] Total Mortgage Blog

The Choice Between FHA and Conventional Foundry Mortgage

FHA vs Conventional Loan comparison chart

Find The Better Loan For Your Budget.

If You’re Shopping For A Mortgage In 2025, It’s Essential To Understand The Key Differences Between Fha And Conventional Loans.

Discover The Pros And Cons Of Conventional Loan Vs Fha Loan Options In Our Comprehensive Guide.

Compare Both Fha And Conventional Mortgage Programs To Get Proper Understanding Of Your Situation.

Related Post:

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

![FHA vs Conventional Loans How to Choose [Updated for 2018] Total Mortgage Blog](https://www.totalmortgage.com/blog/wp-content/uploads/2017/11/Conventional-vs-FHA-Infographic-1.png)