Eitc Tax Credit Chart

Eitc Tax Credit Chart - The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. The preparer must take a closer look at aunt joan's agi and. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. The case of the unclear aunt? 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit (cdcc) head of household (hoh) filing status the child must meet the. Common eitc questions and answers find the answers to the questions clients ask about eitc. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. The preparer must take a closer look at aunt joan's agi and. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. The case of the unclear aunt? Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit (cdcc) head of household (hoh) filing status the child must meet the. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! It promotes awareness of eitc eligibility and where to find additional eitc information. The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. Common eitc questions and answers find the answers to the questions clients ask about eitc. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! Common eitc questions and answers find the answers to the questions clients ask about eitc. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. Publication. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! Education credit/aotc and lifetime learning credits if you haven't found the answer to your. Common eitc questions and answers find the answers to the questions clients ask about eitc. Income limits and amount of eitc for additional tax years see the earned income,. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. It promotes awareness of eitc eligibility and where to find additional eitc information. Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit (cdcc) head of household (hoh) filing. Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. It promotes awareness of eitc eligibility and where to find additional eitc information. The. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. The preparer must take a closer look at aunt joan's agi and. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. The case of the unclear aunt? Income limits and amount of eitc for additional tax years see the. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. 50. The case of the unclear aunt? Education credit/aotc and lifetime learning credits if you haven't found the answer to your. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! The preparer must take a closer look at aunt joan's agi and. Publication 962 (en/sp), earned income tax credit pdf (english on one. It promotes awareness of eitc eligibility and where to find additional eitc information. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit. It promotes awareness of eitc eligibility and where to find additional eitc information. Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit (cdcc) head of household (hoh) filing status the child must meet the. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. The following items answer questions preparers. The preparer must take a closer look at aunt joan's agi and. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the.. The case of the unclear aunt? Publication 962 (en/sp), earned income tax credit pdf (english on one side;. The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. The preparer must take a closer look at aunt joan's agi and. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. It promotes awareness of eitc eligibility and where to find additional eitc information. Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. Common eitc questions and answers find the answers to the questions clients ask about eitc.Earned Tax Credit Tax Credits for Workers and Their Families

Earned Tax Credit City of Detroit

Earned Credit 2024 Tax Table Image to u

The Earned Tax Credit (EITC) A Primer Tax Foundation

2017 vs 2018 Earned Tax Credit (EITC) Qualification and Thresholds Saving to Invest

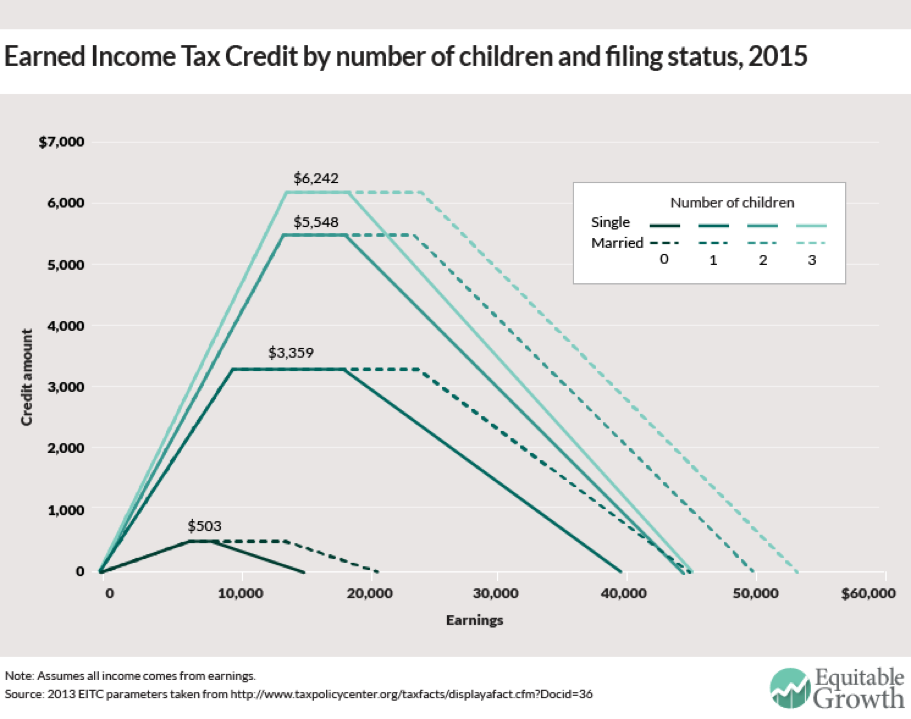

The Earned Tax Credit Equitable Growth

T220252 Tax Benefit of the Earned Tax Credit (EITC), Baseline Current Law

The Federal Earned Tax Credit, Explained by Maryland Child Alliance Medium

Overview of the Earned Tax Credit on EITC Awareness Day

2022 Eic Tax Table Chart

50 Years Of Strengthening America’s Working Families Join Us In Celebrating The Earned Income Tax Credit (Eitc)!

Earned Income Tax Credit (Eitc) Credit For Other Dependents (Odc) Child And Dependent Care Credit (Cdcc) Head Of Household (Hoh) Filing Status The Child Must Meet The.

Education Credit/Aotc And Lifetime Learning Credits If You Haven't Found The Answer To Your.

Related Post: