Amortization Charts Printable

Amortization Charts Printable - Amortization and depreciation are two methods of calculating the value of business assets over time. Amortization is the process of spreading out the cost of an asset over a period of time. It also determines out how much of your repayments will go towards. Typically, the monthly payment remains the same, and it's divided among interest costs (what. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization is a technique to calculate the progressive utilization of intangible assets in a company. There are different methods and calculations that can be used for amortization, depending on the situation. Entries of amortization are made as a debit to amortization expense, whereas it is. In finance, this term has two primary applications: Amortization is the practice of spreading an intangible asset's cost. Amortization and depreciation are two methods of calculating the value of business assets over time. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. There are different methods and calculations that can be used for amortization, depending on the situation. Typically, the monthly payment remains the same, and it's divided among interest costs (what. It aims to allocate costs fairly, accurately, and systematically. Amortization is the way loan payments are applied to certain types of loans. Entries of amortization are made as a debit to amortization expense, whereas it is. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. 1) the gradual reduction of a loan balance. Typically, the monthly payment remains the same, and it's divided among interest costs (what. Amortization is a technique to calculate the progressive utilization of intangible assets in a company. Amortization is the way loan payments are applied to certain types of loans. Amortization is the process of paying off a debt or loan over time in predetermined installments. In finance,. Amortization is the process of spreading out the cost of an asset over a period of time. For help determining what interest rate you might pay, check out today’s mortgage rates. There are different methods and calculations that can be used for amortization, depending on the situation. In finance, this term has two primary applications: Amortization and depreciation are two. Amortization is the process of spreading out the cost of an asset over a period of time. 1) the gradual reduction of a loan balance. Amortization is the process of paying off a debt or loan over time in predetermined installments. There are different methods and calculations that can be used for amortization, depending on the situation. In finance, this. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. It also determines out how much of your repayments will go towards. For help determining what interest rate you might pay, check out today’s mortgage rates. Amortization is the way loan payments are applied to certain types of. Amortization is the process of paying off a debt or loan over time in predetermined installments. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. Amortization is the way loan payments are applied to certain types of loans. For help determining what interest. There are different methods and calculations that can be used for amortization, depending on the situation. Entries of amortization are made as a debit to amortization expense, whereas it is. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization is a technique to calculate the progressive. For help determining what interest rate you might pay, check out today’s mortgage rates. Amortization is the practice of spreading an intangible asset's cost. It also determines out how much of your repayments will go towards. Typically, the monthly payment remains the same, and it's divided among interest costs (what. 1) the gradual reduction of a loan balance. Amortization is the process of spreading out the cost of an asset over a period of time. It also determines out how much of your repayments will go towards. For help determining what interest rate you might pay, check out today’s mortgage rates. Amortization and depreciation are two methods of calculating the value of business assets over time. There are. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization is a technique to calculate the progressive utilization of intangible assets in a company. Amortization and depreciation are two methods of calculating the value of business assets over time. Amortization is the process of spreading out the. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. Typically, the monthly payment remains the same, and it's divided among interest costs (what. Amortization is a technique to calculate the progressive utilization of intangible assets in a company. Amortization is the practice of. For help determining what interest rate you might pay, check out today’s mortgage rates. Entries of amortization are made as a debit to amortization expense, whereas it is. Amortization and depreciation are two methods of calculating the value of business assets over time. Amortization is the practice of spreading an intangible asset's cost. There are different methods and calculations that can be used for amortization, depending on the situation. Amortization is the process of paying off a debt or loan over time in predetermined installments. Typically, the monthly payment remains the same, and it's divided among interest costs (what. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. 1) the gradual reduction of a loan balance. Amortization is the process of spreading out the cost of an asset over a period of time. It also determines out how much of your repayments will go towards.Amortization Schedule Free Printable

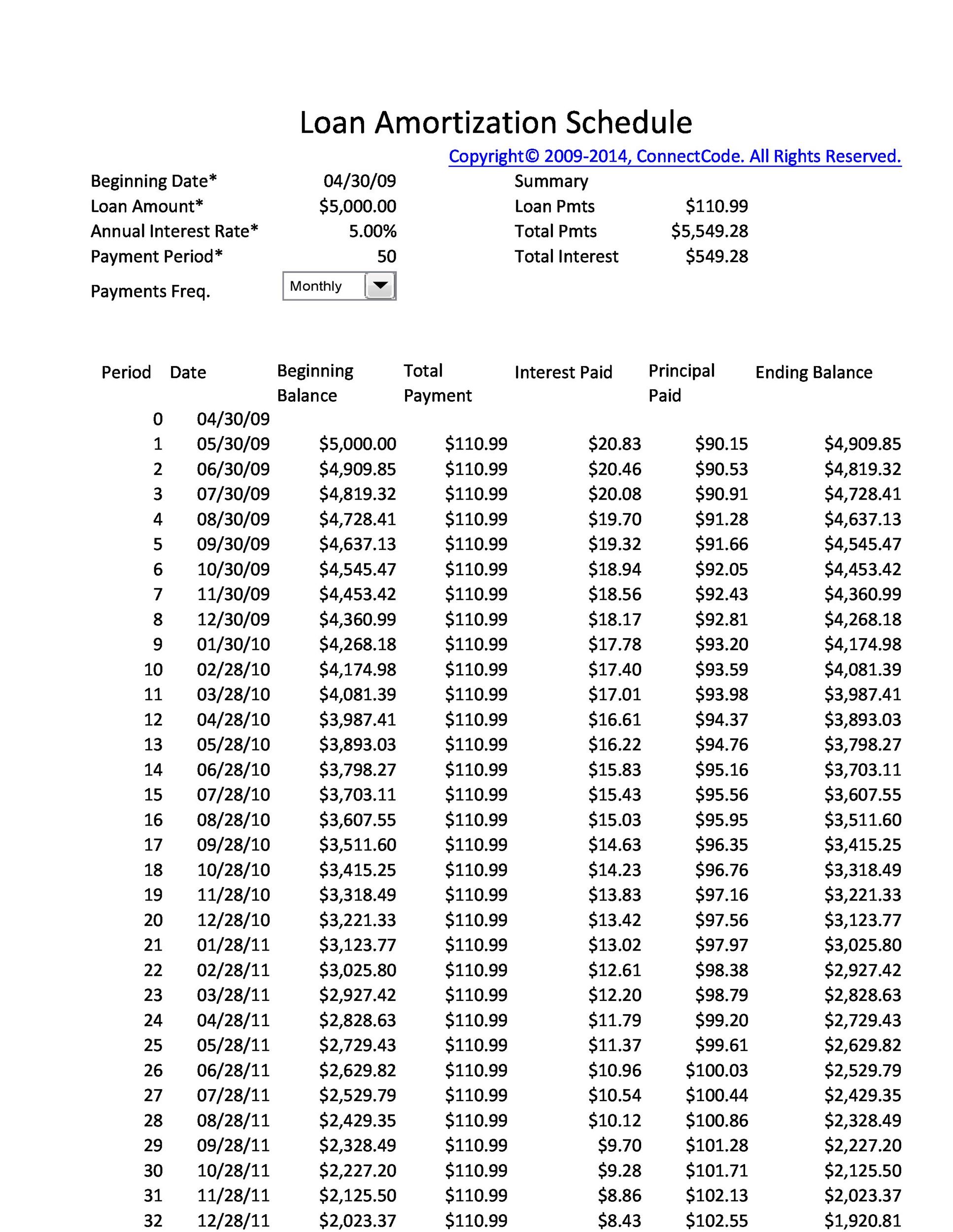

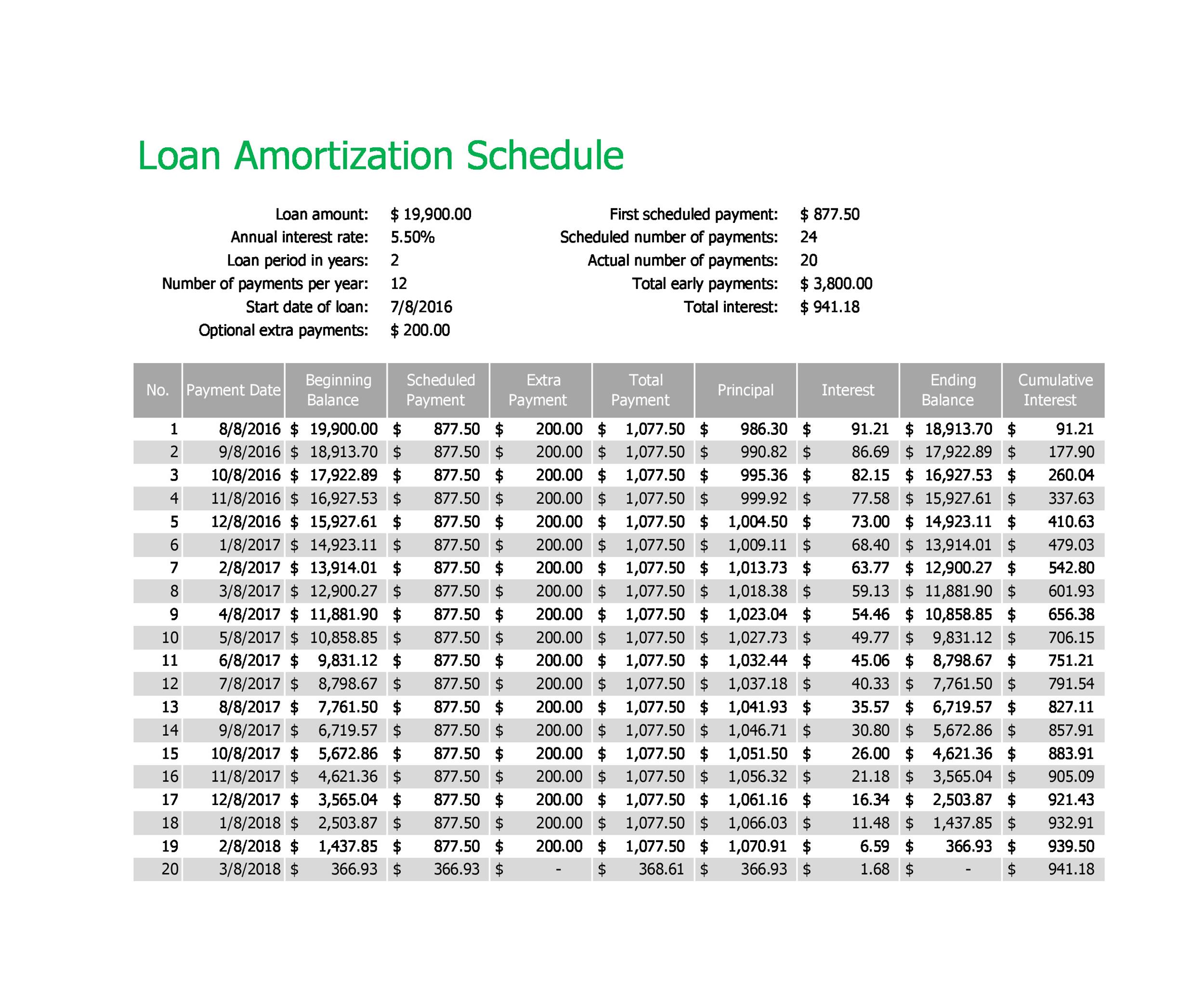

Free Printable Amortization Schedule Templates [PDF, Excel]

Free Printable Amortization Schedule Templates [PDF, Excel]

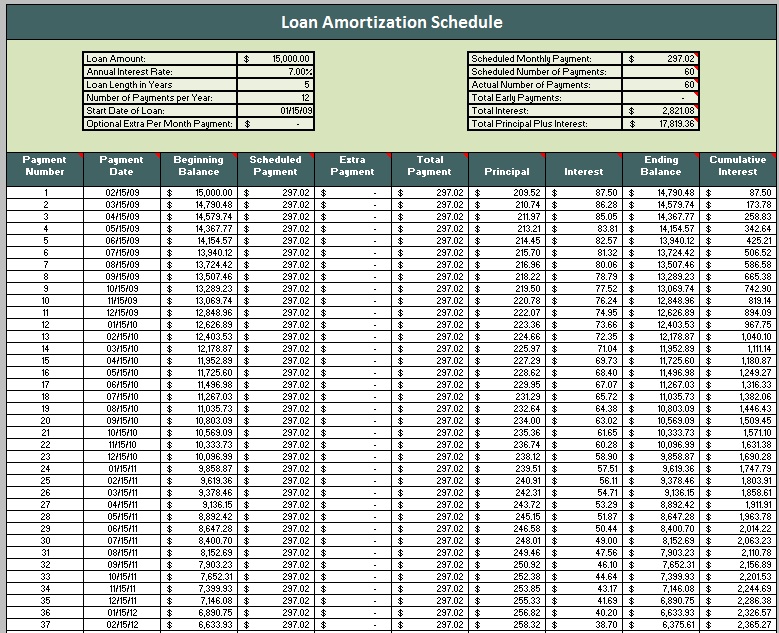

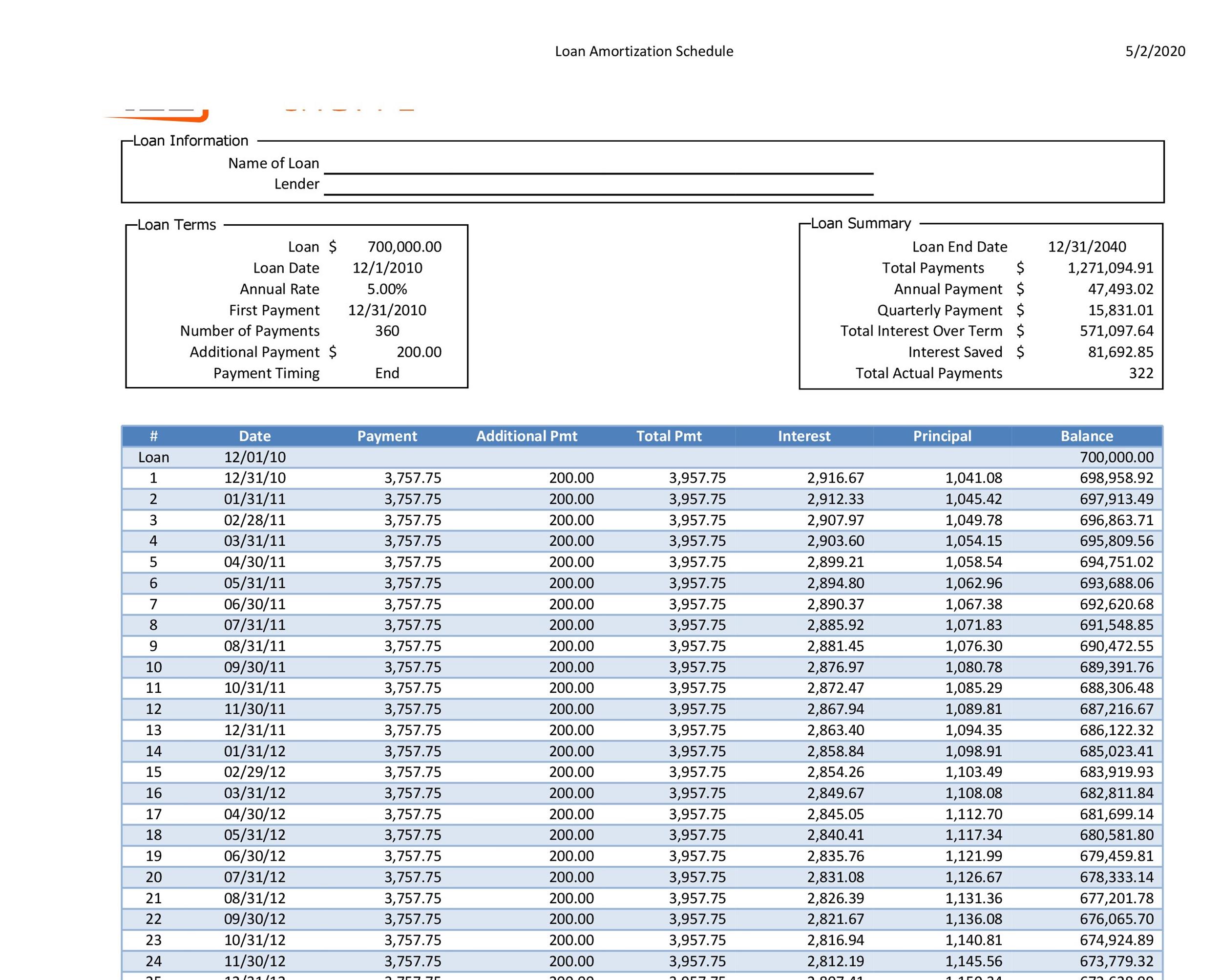

28 Tables to Calculate Loan Amortization Schedule (Excel) Template Lab

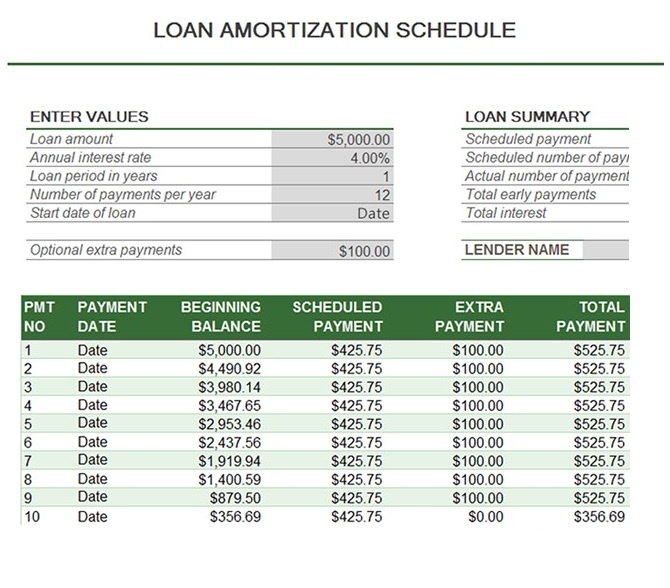

Printable Amortization Schedule With Extra Payments FreePrintable.me

10 Free Amortization Schedule Templates in MS Word and MS Excel

28 Tables to Calculate Loan Amortization Schedule (Excel) ᐅ TemplateLab

Free Printable Loan Amortization Schedule

Free Amortization Schedule Printable

28 Tables to Calculate Loan Amortization Schedule (Excel) Template Lab

Amortization Is A Technique To Calculate The Progressive Utilization Of Intangible Assets In A Company.

In Finance, This Term Has Two Primary Applications:

It Aims To Allocate Costs Fairly, Accurately, And Systematically.

Amortization Is The Way Loan Payments Are Applied To Certain Types Of Loans.

Related Post:

![Free Printable Amortization Schedule Templates [PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/04/create-amortization-schedule.png)

![Free Printable Amortization Schedule Templates [PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/04/amortization-schedule.png?gid=37)